When the Gramm-Leach-Bliley Act authorized financial conglomeration in 1999, Professor Arthur Wilmarth, Jr. presciently predicted that diversified financial holding companies would try to exploit their bank subsidiaries by transferring government subsidies to their nonbank affiliates. To prevent financial conglomerates from taking advantage of their insured depository subsidiaries in this way, policymakers instructed a bank’s board of directors to act in the best interests of the bank, rather than the bank’s holding company. This symposium Article, written in honor of Professor Wilmarth’s retirement, contends that this legal safeguard ignores a critical conflict of interest: the vast majority of large-bank directors also serve as board members of their parent holding companies. These dual directors are therefore poorly situated to exercise the independent judgment necessary to protect a bank from exploitation by its nonbank affiliates. This Article proposes to strengthen bank governance—and better insulate banks from their nonbank affiliates—by mandating that some of a bank’s directors be unaffiliated with its holding company. As long as banks are permitted to affiliate with nonbanks, this reform is essential to ensure that someone is looking out for the well-being of insured depository institutions.

PDF: Jeremy C. Kress,* Who’s Looking Out for the Banks?

Introduction

Two decades ago, Congress passed the Gramm-Leach-Bliley Act and, in doing so, repealed the Glass-Steagall Act’s Depression-era separation between commercial banking and other financial activities.[1] At the time, Professor Arthur Wilmarth, Jr. stood nearly alone in opposing this so-called financial modernization.[2] Permitting commercial banks to affiliate with investment banks and insurance companies, Wilmarth warned, would undermine the banking system by shifting firms’ focus from socially productive lending to risky speculation and capital markets activities.[3]

Twenty years later, Wilmarth’s concerns appear to have been warranted. After Gramm-Leach-Bliley, nearly all large bank holding companies (BHCs) quickly took advantage of the opportunity to expand into nontraditional business lines.[4] The 2008 financial crisis expedited this transition, as JPMorgan and Bank of America acquired investment banks Bear Stearns and Merrill Lynch, respectively.[5] Meanwhile, the largest remaining investment banks, Goldman Sachs and Morgan Stanley, themselves became BHCs.[6] Today, the largest financial conglomerates routinely generate much of their profits from capital markets activities, while their traditional bank lending has dropped to historic lows.[7] Thus, in the decades since Gramm-Leach-Bliley, the United States’ largest financial companies transformed from consumer- and commercial-oriented lenders into capital market-driven financial conglomerates, just as Wilmarth predicted.

One of Wilmarth’s primary concerns about Gramm-Leach-Bliley was that financial conglomerates might exploit their depository institution subsidiaries to benefit their nonbank affiliates.[8] Banks, of course, enjoy several forms of government support.[9] For example, the Federal Deposit Insurance Corporation (FDIC) guarantees bank deposits, providing a reliable and cheap source of funding for insured institutions.[10] Banks may access the Federal Reserve’s discount window for liquidity.[11] And banks perceived as systemically important obtain market funding at artificially low rates because creditors believe the government would not allow them to fail.[12] Collectively, this “federal safety net” provides a valuable subsidy to insured depository institutions.[13] In the absence of Glass-Steagall’s structural separations, Wilmarth justifiably worried that a bank’s nonbank affiliates would seek to avail themselves of this subsidy through preferential loans, asset sales, or other intra-company transactions.[14]

Exploitation of bank subsidiaries by their parent holding companies is problematic for several reasons. When a bank transfers its federal safety net to a nonbank affiliate, it extends the scope of government subsidies and encourages the affiliate to take excessive risks.[15] Moreover, expanding the federal safety net to nonbank affiliates distorts competition with rival firms that are unaffiliated with a depository institution and therefore do not receive comparable subsidies.[16] Further, unsound loans to or asset purchases from a nonbank affiliate may impair a bank’s financial condition, threatening its depositors and other creditors.[17]

Thus, when a bank operates as part of a broader financial conglomerate, stakeholders should—at least in theory—seek to protect the depository institution from exploitation by its affiliates. Optimally, regulators would establish rules preventing the conglomerate from taking advantage of its depository institution subsidiary. Supervisors would closely monitor firms’ compliance with these restrictions. And the bank’s directors and officers would zealously safeguard the bank’s interests in all dealings with its parent company and other affiliates.

This Article contends, however, that despite—or perhaps because of—escalating conglomeration in the U.S. financial sector, no one is currently looking out for the banks. Consider the bank regulatory agencies. Affiliate transaction limits in sections 23A and 23B of the Federal Reserve Act ostensibly shield banks from exploitation by their nonbank affiliates.[18] But, as Professor Wilmarth and Professor Saule Omarova have documented, these safeguards are underenforced.[19] Regulators routinely waive or water down limits on inter-affiliate transactions—especially during times of crisis.[20] Prioritizing the stability of financial conglomerates over the condition of their bank subsidiaries, the agencies permit value to seep out of—or risk to migrate into—insured depository institutions.[21] Moreover, even if the regulatory agencies wanted to enforce inter-affiliate transaction limits, the statutory restrictions are typically easy for companies to evade and difficult for supervisors to monitor effectively.[22] The regulatory agencies, therefore, are unlikely to stop financial conglomerates from taking advantage of their bank subsidiaries.

Equally troubling—and less well understood—is that bank directors cannot be counted on to protect the very banks they represent. That is because the vast majority of bank directors serve simultaneously as directors of their banks’ parent companies. Drawing on a hand-collected dataset, this Article exposes significant overlaps between the boards of the United States’ largest financial conglomerates and their bank subsidiaries.[23] These overlaps create conflicts of interest that potentially undermine the safety and soundness of the banking system. U.S. banking law presumes that bank directors zealously protect the interests of their depository institutions.[24] For example, Federal Reserve rules require a bank’s directors to preapprove certain transactions with its affiliates.[25] But since many bank directors also serve on the board of their bank’s parent company—and are accountable to the parent company’s shareholders—they are ill-suited to protect the bank from exploitation by its affiliates.

Consider the United States’ largest financial conglomerate, JPMorgan Chase & Co. In 2020, ten individuals, including chief executive officer (CEO) Jamie Dimon, served on the company’s board.[26] Those same ten individuals comprised the board of the firm’s lead bank subsidiary, JPMorgan Chase Bank, N.A., with Dimon also serving as CEO of the bank.[27] Thus, the ten people who were responsible for safeguarding the bank’s $3 trillion in assets were, at the same time, in charge of maximizing the holding company’s value, including its substantial nonbank activities.[28] Since extending the bank’s federal safety net to its nonbank affiliates could improve the holding company’s performance, JPMorgan’s directors faced an inherent conflict of interest.[29] And JPMorgan is not alone. Approximately half of the largest banks in the United States have board membership that overlaps entirely with their holding company boards.[30]

This Article recommends that policymakers should strengthen bank governance—and better insulate banks from their nonbank affiliates—by requiring at least some of a bank’s directors to be unaffiliated with its parent holding company. Mandating that a bank appoint directors who do not work for or otherwise represent the holding company would ensure that the bank’s board is equipped to look out for the depository institution when its interests conflict with those of its nonbank affiliates. There is strong precedent, both internationally and domestically, for this approach.[31] The Article proposes a sliding scale: financial conglomerates with significant nonbanking operations should maintain a majority of unaffiliated directors on their bank subsidiary boards, while conglomerates in which the bank is the dominant business line could have fewer unaffiliated bank directors.[32] In the interests of efficiency, this requirement should apply only to BHCs with more than $100 billion in assets and significant nonbank operations.

Professor Wilmarth urges Congress to mitigate conflicts of interest within financial conglomerates by reinstating Glass-Steagall’s structural separation between commercial banking and other financial activities.[33] His proposal merits serious consideration. In the meantime, the federal banking agencies should use their existing regulatory authority to limit financial conglomerates’ ability to take advantage of the federal safety net. By mandating that banks appoint directors unaffiliated with their holding company, regulators could ensure that a bank’s board prioritizes the insured depository institution, rather than the holding company. This governance reform is necessary to safeguard banks and limit the imprudent expansion of the federal safety net as long as commercial banks are permitted to affiliate with investment banks, insurance companies, and other nonbank firms.

This Article contributes to a growing body of literature that promotes corporate governance reform as an essential tool for financial policymakers.[34] As Professors Steven Schwarcz and David Min have observed, regulating financial institutions’ governance is often more effective than regulating the substance of their transactions because it does not require policymakers to constantly update rules in response to financial innovation and regulatory arbitrage.[35] Instead, corporate governance reforms—like the unaffiliated-director mandate proposed here—realign a bank’s internal processes so that its leaders, who are closest to the bank’s decision-making and best positioned to prevent misconduct, are more likely to exercise their authority consistent with public policy objectives.[36]

This Article proceeds as follows. Part I explains why banks receive special subsidies and how the federal safety net puts banks at risk of exploitation by their affiliates. Part II then assesses existing legal protections to prevent financial conglomerates from taking advantage of their bank subsidiaries. It reveals that key stakeholders—including shareholders, directors and officers, and regulators—lack sufficient incentive or ability to protect depository institutions and limit the unauthorized extension of the federal safety net. Part III proposes to address this shortcoming by requiring large commercial banks to appoint at least some directors who are unaffiliated with their nonbank affiliates. The Article concludes that this governance reform is essential to mitigate conflicts of interest within financial conglomerates and to ensure that someone looks out for the banks.

I. Banks’ Enduring “Specialness”

For decades, it has been widely understood that banks are “special.”[37] Banks safeguard customers’ deposits, provide access to the payment system, and serve as a conduit for the implementation of monetary policy. In turn, banks receive special government subsidies to help them perform these critical functions. Federal subsidies, however, create the risk that when a depository institution operates as part of a broader financial conglomerate, its nonbank affiliates could attempt to avail themselves of the government safety net. This Part explains why banks are still “special” despite increasing convergence within the financial sector. It then examines the federal safety net for banks and the risk that a financial conglomerate might exploit its depository institution subsidiary to take advantage of these subsidies.

A. Banks Are (Still) Special

Banks are special because they perform several functions that are essential to the financial system and the broader economy. For example, banks protect customer deposits and, at the same time, use these funds to extend credit to borrowers.[38] In addition, banks provide the channel through which most businesses, households, and governments access the payment system to send and receive money.[39] Banks have also traditionally served as the primary “transmission belt” for monetary policy through which central banks adjust the money supply and thereby influence macroeconomic conditions.[40] In sum, many aspects of the modern economy depend on the banking system.

Depository institutions are special for a second reason: their business model creates distinctive risks. Most significantly, because banks fund long-term, illiquid assets with short-term, liquid liabilities, they are vulnerable to runs by depositors and other short-term creditors.[41] Since banks are typically thinly capitalized, bank runs can lead to fire sales that quickly threaten a depository institution’s solvency.[42] Further, given interconnections among banks and other financial institutions—and the extent to which businesses and households rely on banks as a source of credit—negative externalities from bank failures can spill over to the rest of the financial sector and the broader economy.[43] Taken together, these risks have traditionally been cited as a primary justification for prudential regulation of the banking system.[44]

Some commentators have questioned whether banks are still special, since bank-like activities have migrated outside the traditional banking system over time.[45] Today, nonbank lending companies, investment funds, and the capital markets compete with banks as a source of credit for households and businesses.[46] Money market mutual funds (MMMFs) safeguard customer funds in instruments functionally similar to bank accounts.[47] Cryptocurrency exchanges, peer-to-peer platforms, and other fintech companies provide alternatives for accessing the payment system.[48] Even monetary policy is no longer uniquely dependent on the banking system, as the Federal Reserve relies on open-market operations with nonbank broker-dealers to implement its macroeconomic objectives.[49] Many of these nonbanks, moreover, create financial stability risks similar to those of traditional banks.[50]

Despite increasing convergence in the financial sector, however, banks remain special. While banks may no longer be unique relative to certain nonbank financial companies, they still serve essential economic functions and create potential systemic risks—two characteristics that warrant particular attention. As former Governor of the Bank of England Eddie George put it, “[W]hile in some respects [banks] may be less special than they were, they remain special nonetheless. They remain special in terms of the particular functions they perform . . . [a]nd they remain special in terms of the particular characteristics of their balance sheets. . . .”[51] In light of banks’ enduring specialness, therefore, the government provides an expansive federal safety net to help them fulfill their core functions safely and effectively, as the next Section explains.

B. Banks (Still) Receive Special Subsidies

In recognition of banks’ special role in the economy, policymakers have traditionally granted depository institutions several types of subsidies. Safety net policies, such as federal deposit insurance and the Federal Reserve’s discount window, are generally thought to mitigate risks inherent in banking, but these programs also provide significant economic value to depository institutions. Moreover, implicit government support for “too big to fail” (TBTF) banks allows the largest depository institutions to borrow at artificially low rates. Although policymakers tried to rein in certain bank subsidies after the 2008 financial crisis, empirical studies have confirmed that depository institutions still derive considerable value from the federal safety net.

Some bank safety net policies are explicit. Most notably, the FDIC insures customers’ bank accounts to alleviate incentives for depositors to withdraw their money in a panic.[52] While deposit insurance reduces the risk of debilitating bank runs, it also provides banks with access to abnormally cheap funding.[53] Indeed, because of the FDIC’s backing, banks borrow insured deposits at close to the risk-free rate.[54] Banks pay premiums to the FDIC that, in theory, help to offset the value of deposit insurance. But the FDIC sets its premiums below an actuarially fair price, and deposit insurance thus provides banks with a significant subsidy.[55]

The government supports banks through other safety net policies as well. For example, the Federal Reserve’s discount window allows banks to borrow directly from the central bank when they need liquidity.[56] Although discount window loans are typically made at a penalty rate, the Federal Reserve—in contrast to the private sector—does not charge firms to establish what amounts to a standing line of credit.[57] Access to the discount window therefore operates as a subsidy to banks.[58] Similarly, as Professor Kathryn Judge has pointed out, the government-sponsored Federal Home Loan Banks provide a valuable safety net to their member banks through subsidized advances and dividends.[59] The Federal Reserve’s guarantee of banks’ overdraft payments made via the Fedwire service likewise provides a safety net to depository institutions.[60]

In addition to these explicit subsidies, some banks also benefit from implicit government support. Traditionally, market participants have perceived certain large, complex banks as TBTF.[61] Observers assume that if such a bank were to experience distress, the government would bail out the company rather than risk a disorderly collapse that might destabilize the financial system.[62] This perception of implicit government backing, in turn, creates significant advantages for the TBTF bank. Since market participants believe that the government will not allow a TBTF bank to collapse, creditors lend to banks perceived to be TBTF at artificially low rates.[63] Thus, for example, the largest banks paid almost 40 basis points less to their depositors in the lead-up to the 2008 financial crisis because of this implicit government subsidy.[64]

Policymakers attempted to eliminate the TBTF subsidy after the 2008 crisis, but they were not entirely successful. Congress tried to signal through the Dodd-Frank Act’s Orderly Liquidation Authority and limitations on the government’s bailout powers that large, complex banks would no longer be treated as TBTF.[65] These new policies, however, did not eliminate large banks’ funding advantages, suggesting that the market does not view the government’s anti-bailout pledge as credible.[66] Moreover, large banks’ funding advantages intensified as the COVID-19 pandemic emerged in early 2020.[67] Thus, the market still believes that the government will bail out banks during times of stress, thereby providing the largest banks with an implicit government subsidy.

In sum, banks continue to benefit from an expansive federal safety net. In particular, deposit insurance, discount window access, and implicit government subsidies provide considerable value to depository institutions. Because of these benefits, however, a bank’s nonbank affiliates might attempt to exploit the depository institution to claim federal subsidies for themselves, as discussed in the next Section.

C. The Risk of Exploitation by Affiliates

When a bank operates as part of a diversified financial conglomerate, the conglomerate and its nonbank subsidiaries have an incentive to take advantage of the bank’s federal safety net. Professor Howell Jackson has called this phenomenon the “hungry wolf” problem, noting that “holding companies are prone to prey upon their regulated subsidiaries.”[68] A bank’s affiliates may exploit the bank—and thereby avail themselves of federal subsidies—in several ways.

One straightforward way a bank’s affiliate might take advantage of the federal safety net is by obtaining a cheap loan from the depository institution. As discussed above, a bank’s cost of capital for insured deposits is near the risk-free rate because of federal deposit insurance.[69] If a bank were to lend to a nonbank affiliate at a below-market interest rate, the nonbank could receive the benefit of federally subsidized funding.[70] That is what happened during the 2008 financial crisis, when Citibank, Bank of America, and JPMorgan Chase Bank sought to bolster their broker-dealer affiliates—which were rapidly losing funding—by lending them billions of dollars with the encouragement of the Federal Reserve.[71] These types of loans are problematic, not only because they expand the federal safety net but also because they could jeopardize the depository institution’s safety and soundness if the loans are not prudently underwritten.[72]

Financial conglomerates can also exploit the federal safety net by transferring low-quality assets to their banks. When a bank buys assets from its affiliates at an inflated price, “[t]he difference between the market price of the purchased assets and the intracompany price paid can amount to a subsidized funds transfer from the bank to its affiliate.”[73] Even when an intracompany sale is conducted on market terms, the financial conglomerate may benefit from transferring assets to the bank because the FDIC, as the bank’s insurer, bears some of the risk.[74] Thus, it is common for financial institutions to try to move risky assets into their depository institutions, such as when Citigroup transferred the vast majority of its subprime mortgage assets into Citibank in the lead-up to the 2008 financial crisis.[75] Likewise, conglomerates transferred risky asset-backed commercial paper from their affiliated MMMFs to their banks during the peak of the crisis.[76]

A third way in which a financial conglomerate can exploit the federal safety net is by causing its depository institution to declare dividends and then redistributing these funds to its nonbank subsidiaries. As two banking law practitioners observed, “[t]o the extent a bank has available earnings out of which to declare dividends, it could provide subsidized funding to its BHC—for redeployment to other members of the banking group. . . .”[77] Thus, rather than transferring federal safety net benefits through preferential loans or asset purchases, a bank might simply give subsidized capital to its affiliates via dividend payments to the holding company.[78] At least two former Comptrollers of the Currency have warned of financial conglomerates taking advantage of their bank subsidiaries in this way.[79] And FDIC researchers have found empirical evidence that BHCs do, in fact, use internal dividends from their bank subsidiaries to exploit the federal safety net.[80]

In addition to these standard strategies, financial engineering permits nonbanks to exploit their depository affiliates in even more complex ways. For example, a nonbank could enter into swap transactions with its bank affiliate in which the nonbank posts insufficient collateral to offset its counterparty risk.[81] Similarly, a nonbank might use derivatives to transfer the economic risk of dubious assets to its bank affiliate without the bank being required to recognize those assets on its balance sheet.[82] Alternatively, a bank could guarantee certain assets or obligations of its nonbank affiliates.[83] A depository institution could also provide preferential loans to an affiliate’s customers or suppliers, who might then return a portion of the subsidy to the financial conglomerate when transacting with the nonbank company.[84] With the help of financial engineering, therefore, a nonbank may take advantage of its depository institution affiliate in numerous ways.

To be sure, there are legal limits on a bank’s transactions with its nonbank affiliates, but these restrictions are generally inadequate to prevent exploitation. Section 23A of the Federal Reserve Act limits a bank’s covered transactions with a single affiliate to no more than 10 percent of the bank’s capital and prohibits a bank from purchasing low-quality assets from its affiliates.[85] Section 23B of the same statute requires transactions between a bank and its affiliates to be on market terms.[86] As Professor Saule Omarova has noted, however, Congress adopted these rules decades before the Gramm-Leach-Bliley Act permitted commercial banks to affiliate with broker-dealers, insurance companies, and other nonbanks.[87] When financial conglomerates expanded into new areas, bank supervisors found it difficult to police transactions with nonbank affiliates engaged in exotic financial activities not contemplated when sections 23A and 23B were enacted.[88] Professor Omarova concludes, therefore, that the Federal Reserve Act’s affiliate transaction rules are “not well-suited to serve as the principal guarantee of the safety and soundness of the depository system in today’s increasingly complex and dynamic financial marketplace.”[89]

Regulatory enforcement of bank exploitation has indeed suffered in the era of financial conglomeration. As Professor Omarova has documented, banking regulators have regularly granted exemptions from affiliate transaction limits, especially during the 2008 financial crisis.[90] In addition, the Federal Reserve still has not proposed updates to its affiliate transaction regulation to incorporate the Dodd-Frank Act’s amendments strengthening sections 23A and 23B more than a decade after the statute came into force.[91] Regulators have even made it easier for financial conglomerates to take advantage of their depository institutions by rolling back rules that required nonbanks to post collateral on derivative transactions with their bank affiliates.[92] Section II.C of this Article explores these regulatory shortcomings in greater detail.

In sum, financial conglomerates have both strong incentives and ample opportunities to exploit their bank subsidiaries. At least in theory, therefore, stakeholders should closely monitor depository institutions to prevent exploitation and stop the inappropriate expansion of the federal safety net. As the next Part explains, however, in the modern financial system, no one looks out for the banks.

II. Who is Looking Out for the Banks?[93]

Despite the threat of exploitation, nobody protects depository institutions from their nonbank affiliates. In theory, shareholders, bank directors and officers, and regulators could all watch over banks and help prevent mistreatment.[94] This Part contends, however, that none of these stakeholders has both the incentive and ability to shield banks from their affiliates. In fact, each of these stakeholders may benefit when a financial conglomerate takes advantage of its depository institutions. Thus, in the U.S. financial system as currently configured, none of these parties should be counted on to look out for the banks.

As an initial matter, shareholders are unlikely to prevent nonbanks from exploiting their bank affiliates. At present, all of the largest U.S. commercial banks are owned by publicly traded BHCs.[95] In general, a BHC shareholder benefits from maximizing the value of the parent company and, thus, has little incentive to care about a bank subsidiary vis-à-vis the broader financial conglomerate. Moreover, even if a BHC shareholder wanted to monitor a bank’s transactions with its affiliates, the shareholder would have limited ability to oversee the financial conglomerate’s inner workings.

BHC shareholders have an economic incentive to prioritize the performance of the parent holding company over the financial condition of its bank subsidiary. To the extent that preferential loans, asset transfers, or other inter-affiliate transactions increase the value of the consolidated company, rational BHC shareholders would prefer the conglomerate to exploit the bank.[96] BHC shareholders, in essence, own a put option on the bank subsidiary: the shareholders enjoy the bank’s upside—including any safety net subsidies the bank transfers to its nonbank affiliates—but the FDIC bears the residual risks if the bank collapses.[97] Historically, policymakers encouraged bank shareholders to look after the depository institution by subjecting shareholders to double liability when a bank failed.[98] Double liability regimes, however, were repealed after the Great Depression.[99] Today, therefore, BHC shareholders have little incentive to look out for the bank vis-à-vis its affiliates.

Even if BHC shareholders were inclined to monitor a bank’s relationships with its affiliates, they would likely find it difficult to do so. Large, complex financial conglomerates are notoriously opaque to external stakeholders.[100] The types of transactions through which a financial conglomerate might exploit its bank subsidiary are unlikely to be disclosed in sufficiently granular detail for BHC shareholders to observe.[101] Accordingly, BHC shareholders lack both the incentive and the ability to protect banks from exploitation by their affiliates.

B. Directors and Officers?

Internal stakeholders are equally unlikely to stop a financial conglomerate from taking advantage of its depository institution subsidiary. Federal law instructs a bank’s directors to shield the bank from exploitation by its affiliates. But these legal mandates ignore a glaring conflict of interest: most big-bank directors also sit on the board of the bank’s holding company. When a bank director serves the BHC, the director has an incentive to allow the financial conglomerate to exploit the depository institution and thereby take advantage of federal subsidies. In the current system, therefore, bank directors and their appointed officers are unlikely to oversee the bank impartially.

Recognizing a financial conglomerate’s incentive to take advantage of its depository institution, policymakers instruct a bank’s directors to shield the bank from its affiliates. The Office of the Comptroller of the Currency’s (OCC) bank directors’ handbook, for example, states that the “subsidiary bank’s board should ensure that relationships between the bank and its affiliates . . . do not pose safety and soundness issues for the bank. . . .”[102] The OCC further asserts that the “bank’s board should ensure the interests of the bank are not subordinate to the interests of the parent holding company. . . .”[103] In addition, the Federal Reserve requires a majority of a bank’s board of directors to review and approve certain transactions with the bank’s affiliates.[104]

Policymakers presume that bank directors will go to great lengths to protect the bank from its holding company. The OCC states that “[i]f the bank’s board is concerned that the holding company is engaging in practices that may harm the bank . . . the bank’s board should notify the holding company and obtain modifications.”[105] If the holding company fails to address the bank directors’ concerns, the OCC instructs the bank directors to “dissent on the record and consider actions to protect the bank’s interests.”[106] The OCC advises that, if necessary, the bank’s board “should hire an independent legal counsel” or “raise its concerns with its regulators.”[107] Policymakers, in sum, presume that bank directors will zealously safeguard the interests of the bank from its holding company.

The expectation that a bank’s directors will shield the bank from exploitation, however, ignores a potential conflict of interest. When a bank’s directors also sit on the board of the bank’s holding company, the directors have an incentive to allow the holding company and its nonbank subsidiaries to take advantage of the bank and thereby benefit from federal safety net subsidies. Since BHC directors are accountable to shareholders for maximizing the value of the financial conglomerate—not just the bank subsidiary—they may want the bank to engage in preferential loans, asset transfers, or other intracompany transactions that benefit its affiliates.[108] In addition, BHC directors are enriched financially when a bank extends federal safety net subsidies to its affiliates, since board members are often significant shareholders of the BHC.[109] When a bank director serves simultaneously on the board of the parent holding company, therefore, the director is ill-suited to protect the bank from exploitation by its affiliates.[110]

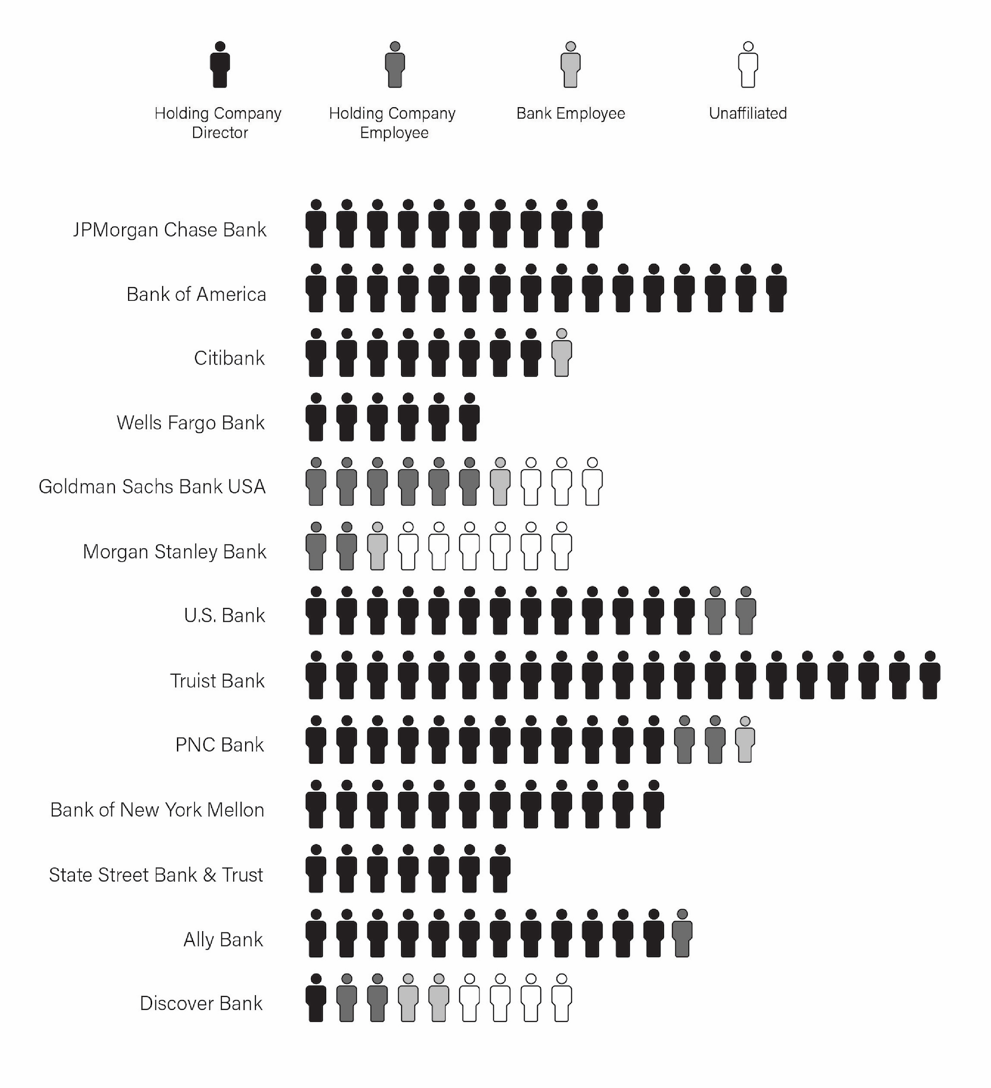

This conflict of interest is far more widespread than is commonly understood. BHCs do not routinely disclose the identities of their bank subsidiaries’ directors.[111] However, some bank board membership information is available in various state and international corporate registries, securities filings, and enforcement actions. Drawing on these resources, I compiled a near-complete dataset of the directors of the lead bank subsidiaries of BHCs with more than $100 billion in assets and more than 1 percent of their assets in nonbanks.[112] This dataset reveals that the vast majority of big-bank directors simultaneously serve as directors of their parent holding companies, as depicted in Figure 1.[113] The membership of each bank’s board of directors is listed in the Appendix.

Figure 1 shows the significant overlap between most large BHCs’ boards and the boards of their bank subsidiaries. Nearly half of the banks in the sample do not have a single director who does not also serve on the board of its BHC. Of the four biggest banks by asset size—JPMorgan Chase Bank, Bank of America, Citibank, and Wells Fargo Bank—only Citibank has a director who does not also sit on its BHC’s board. In total, 119 out of 153 bank directors in the sample—or 78 percent—simultaneously serve on the board of the bank’s holding company.

Figure 1: Bank Director Affiliations[114]

While it is common in many other industries for a parent company director to serve on a subsidiary’s board,[115] dual-directorships raise unique problems in banking. In contrast to other sectors of the economy, the federal safety net creates incentives for a dual BHC-bank director to exploit the subsidiary.[116] While dual BHC-bank directors have a legal obligation to prevent the financial conglomerate from taking advantage of the depository institution,[117] in reality, enforcement against large bank directors is exceedingly rare.[118] Thus, dual BHC-bank directors’ incentives may favor taking advantage of the bank.

Consider an example. At the onset of the COVID-19 pandemic in March 2020, several BHCs sought and received permission from the Federal Reserve to transfer assets from their MMMF and broker-dealer affiliates to their bank subsidiaries.[119] These transactions were reminiscent of the 2008 financial crisis, when banks supported their MMMF and broker-dealer affiliates with widespread asset purchases.[120] The Bank of New York Mellon was reportedly one of the banks that bolstered its nonbank affiliates again in 2020, buying $1.2 billion of assets from affiliated MMMFs to prevent them from collapsing.[121] Of the twelve individuals who oversaw these asset purchases as directors of The Bank of New York Mellon, all twelve simultaneously served on the board of the bank’s holding company.[122] Thus, the same directors who were supposed to protect the bank and prevent the spread of the federal safety net also had incentives to use the bank to stabilize its affiliates. Like many bank directors, therefore, Bank of New York Mellon’s board members may have suffered from conflicts of interest.

Similar to bank directors, bank executives may also be ill-suited to protect a depository institution from exploitation by its affiliates. It is common for a bank’s board to appoint the BHC’s CEO to serve as the CEO of the bank. For example, at three of the four largest U.S. BHCs—JPMorgan, Bank of America, and Wells Fargo—the holding company’s CEO also serves as the CEO of the bank.[123] Like dual BHC-bank directors, a dual BHC-bank CEO may perceive her primary objective as maximizing the value of the financial conglomerate—not just the bank subsidiary.[124] In addition, since dual BHC-bank directors generally receive pay packages tied to BHC performance metrics, a dual CEO may benefit financially by allowing the holding company to exploit its depository institution subsidiary.[125] Further, in cases where a bank executive is not already employed by the holding company, the executive may permit the BHC to take advantage of the bank in the hope of obtaining a promotion to the holding company.[126] In light of these conflicts of interest, therefore, a bank’s executives are unlikely to prevent the BHC from exploiting its bank subsidiary.

In sum, policies that rely on bank directors or executives to shield a depository institution from its nonbank affiliates ignore critical conflicts of interest. Overlaps between bank and BHC boards likely bias directors’ incentives toward expanding federal safety net subsidies. Dual BHC-bank CEOs may have similar motives. In the current system, therefore, neither bank directors nor their appointed officers should be counted on to shield depository institutions from exploitation by their holding companies.

C. Regulators?

Regulators could, in theory, compensate for bank directors’ and officers’ conflicts of interest by proactively policing predatory relationships between BHCs and their depository institutions. In practice, however, regulators consistently allow financial conglomerates to take advantage of their bank subsidiaries.[127] This Section first offers hypotheses as to why regulators permit BHCs to exploit their depository institutions. It then examines three specific ways in which regulators have allowed—and even encouraged—BHCs to take advantage of their banks: by eroding affiliate transaction limits; undermining Dodd-Frank’s swaps push-out provision; and eliminating inter-affiliate margin requirements.

1. Why Regulators Permit BHCs to Exploit Their Banks

Despite their statutory mandates to protect depository institutions,[128] the federal banking agencies often enable financial conglomerates to exploit their bank subsidiaries. To be sure, policing relationships between banks and their affiliates poses serious challenges for the agencies, who face informational disadvantages relative to the institutions they supervise.[129] Compounding these limitations, however, the agencies have affirmatively relaxed regulatory safeguards shielding banks from their holding companies.[130] There are several possible reasons why regulators might permit BHCs to exploit their banks.

First, regulatory capture could explain why the banking agencies allow holding companies to prey on their depository subsidiaries. Professor Wilmarth has documented how conglomeration in the late 1990s and early 2000s increased financial institutions’ influence on regulatory policy.[131] As Wilmarth wrote, “The remarkable expansion of the financial industry’s size, profits and compensation over the past three decades produced a parallel growth in the industry’s political clout.”[132] This clout, Wilmarth asserted, “discourages regulators from imposing tougher restraints on financial institutions.”[133] Subject to pressure from the financial sector, therefore, regulators may relax constraints on banks’ relationships with their affiliates to enable the expansion of federal subsidies.

In addition to regulatory capture, the banking agencies might permit BHCs to take advantage of the federal safety net to further the agencies’ interests in financial stability. Bank regulators have strong incentives to maintain the stability of large BHCs and, by extension, the broader financial system.[134] In some cases, regulators might advance this interest by allowing a BHC to exploit its bank subsidiary. For example, the banking agencies could permit a financial conglomerate to move risky assets into its federally insured bank with the goal of stabilizing the holding company.[135] Alternatively, regulators could roll back protections for depository institutions on the ground that strict firewalls weaken the consolidated company.[136] While regulatory agencies understandably want to promote the stability of the broader financial system, permitting holding companies to exploit their bank subsidiaries creates a moral hazard problem. If financial conglomerates expect that regulators will allow them to exploit their bank subsidiaries in times of crisis, they will take excessive risks during “normal” times.[137]

Even the FDIC—which, as the administrator of the federal deposit insurance system, should have particularly strong motivation to protect depository institutions—has not prevented financial conglomerates from taking advantage of their banks. As Professor Omarova has written, “certain power dynamics among the three [banking] agencies” limit the FDIC’s influence relative to the Federal Reserve and OCC.[138] These power dynamics may stem from the fact that the Federal Reserve and OCC are the primary regulators for the largest financial conglomerates and their bank subsidiaries, while the FDIC mostly oversees smaller banks.[139] Accordingly, the FDIC is sometimes excluded from the other agencies’ decisions about banks’ relationships with their holding companies.[140] Even when the FDIC participates in interagency decision-making, it may be overly deferential to its sister agencies.[141] Thus, although the FDIC could be a potentially powerful check on BHCs taking advantage of their bank subsidiaries, in practice, it oftentimes fails to prevent exploitation.

There are many possible explanations, therefore, why the federal banking agencies permit financial conglomerates to prey on their depository institution subsidiaries. Whether due to some or all of these reasons, policymakers routinely weaken protections for depository institutions, as the next Subsection demonstrates.

2. How Regulators Permit BHCs to Exploit Their Banks

The federal banking agencies enable—and even encourage—BHCs to take advantage of their depository institution subsidiaries by rolling back safeguards designed to shield banks from their affiliates. This Subsection examines three of the most significant ways in which regulators have weakened protections for depository institutions: by eroding affiliate transaction limits, undermining Dodd-Frank’s swaps push-out provision, and eliminating inter-affiliate margin requirements.

a. Eroding Affiliate Transaction Limits

First, the federal banking agencies have relaxed restrictions on depository institutions’ transactions with their affiliates. As discussed above, sections 23A and 23B of the Federal Reserve Act have traditionally protected banks by limiting certain intra-company transactions and requiring all relationships with affiliates to be conducted on market terms.[142] Ever since the Gramm-Leach-Bliley Act authorized financial conglomeration, however, the federal banking agencies have eroded these safeguards through regulatory exemptions and inaction.

Within the first decade after Gramm-Leach-Bliley, the Federal Reserve made frequent use of its authority to exempt affiliate transactions from sections 23A and 23B. Immediately after the September 11, 2001, terrorist attacks, the Federal Reserve suspended section 23A’s quantitative limits “so that major banks could make large transfers of funds to their securities affiliates.”[143] Several years later, when the U.S. housing bubble burst and credit markets froze, the Federal Reserve again issued widespread exemptions allowing financial conglomerates to transfer assets into their bank subsidiaries.[144] In at least one case, the Federal Reserve even waived section 23B’s “market terms” requirement, expressly allowing insured depository institutions to spread federal subsidies to their nonbank affiliates.[145] Although these exemptions did not result in reported losses to insured depository institutions, banks could have suffered sizeable losses from their affiliate transactions had the Federal Reserve not simultaneously supported the financial system with massive liquidity injections.[146]

After the 2008 financial crisis, Congress tried to strengthen the Federal Reserve Act’s limits on affiliate transactions. For example, the Dodd-Frank Act broadened the scope of “covered transactions” subject to section 23A to include derivatives, repurchase agreements, and securities lending arrangements.[147] In addition, Congress curtailed the Federal Reserve’s unilateral authority to grant exemptions from sections 23A and 23B. Under Dodd-Frank, the FDIC may veto any section 23A or 23B exemption it deems to present an unreasonable risk to the deposit insurance fund.[148] With these amendments, Congress “significantly expanded the scope” of sections 23A and 23B and sought to “tighten [their] application.”[149]

Even after these legislative reforms, however, the federal banking agencies continued to erode limits on affiliate transactions through inaction and permissive exemptions. More than ten years after the effective date of Dodd-Frank’s amendments, the Federal Reserve still has not proposed corresponding revisions to the agency’s rule implementing sections 23A and 23B.[150] The absence of an implementing regulation leaves considerable uncertainty as to how the banking agencies apply affiliate transaction limits to derivatives, repurchase agreements, and securities lending arrangements.[151] And despite Congress’s intended limitation on regulatory exemptions, the banking agencies issued widespread exemptions allowing banks to purchase assets from their MMMF and broker-dealer affiliates as soon as the COVID-19 pandemic emerged in early 2020.[152] Thus, notwithstanding Congress’s directives, the regulatory agencies have not tightened limits on affiliate transactions and instead continue to allow depository institutions to spread the federal safety net to their nonbank affiliates.

b. Undermining Dodd-Frank’s Swaps Push-Out Provision

In addition to eroding affiliate transaction limits, regulators’ efforts to undermine Dodd-Frank’s swaps push-out provision demonstrate how the banking agencies prioritize the financial condition of BHCs over their depository-institution subsidiaries. After derivatives exacerbated the 2008 financial crisis, Congress ordered insured depository institutions to transfer, or “push out,” certain swap contracts to separately capitalized nonbank affiliates.[153] Dodd-Frank’s swaps push-out provision—also known as the “Lincoln Amendment”—sought to “minimize ‘the possibility that banks would use cheaper funding provided by deposits insured by the FDIC, to subsidize their trading activities.’”[154] The bank regulatory agencies, however, opposed the swaps push-out provision so vehemently that Congress ultimately backtracked and repealed the Lincoln Amendment.

Despite the Lincoln Amendment’s goal of safeguarding depository institutions, bank regulators criticized the rule because, in their view, the swaps push-out would weaken financial conglomerates. Federal Reserve Chairman Ben Bernanke, for example, protested the requirement that banks move derivatives into a separate affiliate, insisting that “it’s not evident why that makes the company as a whole safer.”[155] In addition, some bank regulators expressed concern that moving swaps from insured depository institutions into nonbank affiliates could impede prudential supervision.[156] Reflecting their concerns, the Federal Reserve and OCC extended the swaps push-out compliance date for two years beyond the statutory deadline.[157] This delay provided time for the agencies and the financial sector to continue lobbying Congress to reconsider the Lincoln Amendment.[158] Eventually, Congress relented and, in 2014, repealed substantially all of the swaps push-out provision.[159]

The repeal of the Lincoln Amendment was a boon to BHCs. As Professor Wilmarth wrote, “The repeal of the Lincoln Amendment permits large financial holding companies to conduct virtually all of their derivative activities within their subsidiary banks, which enjoy the largest federal safety net subsidies and the lowest cost of funding within their holding company structures.”[160] Meanwhile, allowing depository institutions to retain exposures to credit default swaps, commodities swaps, and equity swaps means that risks associated with those instruments will continue to be absorbed by the banks and, if necessary, by the federal deposit insurance fund. Thus, by undermining the Lincoln Amendment’s swap push-out provision, regulators thwarted Congress’s goal of safeguarding depository institutions and, once again, prioritized BHCs over their bank subsidiaries.

c. Eliminating Inter-Affiliate Margin Requirements

Finally, the federal banking agencies have encouraged BHCs to exploit their depository institutions by eliminating inter-affiliate margin requirements. Financial conglomerates have traditionally run their derivatives businesses out of nonbank legal entities and then used swaps to transfer those exposures into their U.S. depository institutions, taking advantage of the federal safety net.[161] Swaps proved problematic during the 2008 financial crisis when counterparties defaulted and saddled their trading partners with losses.[162] In response, Dodd-Frank established new swap margin requirements. Under the new margin rules, a market participant must post collateral to guarantee its performance on a swaps contract, thereby protecting its trading partner in the event that it defaults.[163] Like the swaps push-out rule, however, the regulators effectively neutered Dodd-Frank’s swaps margin requirements by exempting depository institutions from collecting initial margin from their affiliates.

Initially after the 2008 crisis, regulators used Dodd-Frank’s swaps margin requirements to protect the banking system. Dodd-Frank directed the banking agencies to establish margin requirements for all swaps that are not centrally cleared.[164] In addition to instituting margin requirements for swaps between unaffiliated counterparties, the agencies mandated that depository institutions collect initial margin when entering into swaps with their affiliates.[165] As the agencies stated in their final rule, requiring affiliates to post initial margin “should help protect the safety and soundness of [depository institutions] in the event of an affiliated counterparty default.”[166] By 2019, depository institutions had collected more than $44 billion in initial margin from their affiliates to cover intercompany swaps.[167]

The financial sector, however, attacked inter-affiliate margin requirements, and the agencies eventually capitulated. As the Wall Street Journal reported, “JPMorgan Chase & Co., Goldman Sachs Group Inc. and other big banks have made easing the requirements a priority for years.”[168] In response to industry pressure, the Federal Reserve, OCC, and FDIC proposed in 2019 to eliminate the requirement that depository institutions collect initial margin from their affiliates, reasoning that inter-affiliate margin requirements place U.S. institutions at a competitive disadvantage relative to financial companies in other jurisdictions that lack comparable rules.[169] The agencies effectively repealed their inter-affiliate swap margin requirements in a 2020 final rule.[170]

Eliminating inter-affiliate margin requirements allows—indeed, encourages—financial conglomerates to transfer risk into their depository institution subsidiaries. As FDIC Board Member Martin Gruenberg said, removing inter-affiliate margin requirements creates “a meaningful economic incentive” for a financial conglomerate to transfer risks associated with derivative activities to its bank subsidiary instead of unaffiliated market participants because the conglomerate “would not be required to post initial margin to the insured depository institution but would be required to post initial margin to third parties.”[171] In addition, eliminating the inter-affiliate margin requirement permits “insured depository institutions to return the $44 billion in collateral that currently serves as a buffer for the Deposit Insurance Fund” and shields “taxpayers from potential losses that could arise from derivative contracts with affiliates.”[172] As a result, now that regulators have rolled back inter-affiliate margin requirements, banks will be more exposed to their nonbank affiliates.

* * *

In the current system, no stakeholder is likely to prevent financial conglomerates from exploiting their banks. Shareholders benefit when BHCs take advantage of federal subsidies; bank directors and officers are compromised by conflicts of interest; and regulators do not offset these shortcomings with aggressive oversight. The absence of an effective watchdog jeopardizes banks’ safety and soundness, distorts competition, and encourages excessive risk-taking.[173] A new approach is thus necessary to better protect banks from their nonbank affiliates.

III. Protecting Banks Through Better Governance

Traditionally, proposals to better insulate banks from their holding companies have emphasized structural reforms. Professor Wilmarth, for example, favors reinstating the Glass-Steagall Act and thereby severing affiliations between depository institutions and companies engaged in nonbanking activities.[174] Other scholars, including Professor Steven Schwarcz, recommend “ring-fencing” approaches that would create stricter firewalls to isolate banks from their affiliates.[175] These structural reforms merit serious consideration. Implementing these proposals, however, would likely require Congress to pass legislation that has heretofore proven difficult to enact.[176]

This Part suggests an alternative approach to safeguarding banks through stronger corporate governance. Specifically, it recommends that policymakers should require large banks to appoint directors who are unaffiliated with their holding companies or affiliates. As explained below, mitigating bank directors’ conflicts of interests in this way could achieve many of the objectives of the Glass-Steagall Act and other ring-fencing proposals using existing legal authorities.

To be clear, the proposal described here is not a substitute for the sweeping structural reform that Glass-Steagall proponents envision. Alleviating bank directors’ conflicts of interest is an incremental, relatively easy-to-implement strategy for safeguarding depository institutions within the prevailing structure of the U.S. financial system. The corporate governance reforms described below can help prevent the imprudent expansion of the federal safety net for as long as Congress continues to permit financial conglomeration.

A. A Proposal for Unaffiliated Bank Boards

To prevent financial conglomerates from taking advantage of their bank subsidiaries, policymakers should require banks to appoint at least some directors who are unaffiliated with their holding companies. This mandate would mitigate conflicts of interest that currently plague bank governance and, in doing so, would empower banks to resist exploitation by their affiliates. As this Section describes, this approach is consistent with both international and domestic precedent and would be relatively straightforward for regulators to implement using existing legal authorities.

First, a brief description of the proposal. The federal banking agencies—the Federal Reserve, OCC, and FDIC—should adopt a requirement that a BHC with more than $100 billion in assets must appoint at least some unaffiliated directors to the board of its depository institution subsidiary.[177] A director would be considered “unaffiliated” if he or she (1) is not and has never been an officer, employee, or director of the holding company or any of its nonbank affiliates, and (2) is not a member of the immediate family of an officer, employee, or director of the holding company or any of its nonbank affiliates. Unaffiliated directors could be employed by the bank—but not by its holding company or nonbank affiliates—or could be independent of the financial conglomerate entirely.[178]

The agencies should establish a sliding scale to determine how many of a bank’s directors must be unaffiliated. BHCs with a majority of their assets in nonbank legal entities could be required to appoint unaffiliated directors to every seat on their bank subsidiary boards. Because of their heavy focus on nonbank activities, these conglomerates pose the biggest risk of exploiting the federal safety net, and their bank subsidiaries would therefore benefit the most from unaffiliated directors. BHCs with significant nonbank operations—for example, between 10 and 50 percent of their assets in nonbank legal entities—could be required to maintain a majority of unaffiliated directors on their bank subsidiary boards. By contrast, BHCs in which nonbank activities constitute a smaller focus—for example, between 1 and 10 percent of assets—could appoint unaffiliated directors to at least one-third of their bank board seats. In the interests of efficiency, policymakers could exempt large BHCs with de minimis nonbank operations from the requirement to appoint unaffiliated bank directors, as bank-focused conglomerates likely pose the least risk of exploitation.[179] All covered BHCs should have to appoint unaffiliated directors to the most important positions on their bank boards—lead director and chair of the audit and risk committees—because these roles bear special responsibility for overseeing the bank’s risk.[180]

Requiring large banks to appoint unaffiliated directors would have several salutary effects. First, this reform would mitigate conflicts inherent in dual BHC-bank directorships. When an individual serves both a bank and its BHC simultaneously, he or she may have incentives to allow the holding company to exploit the federal safety net.[181] By contrast, when a director serves only the bank—and has no formal ties to the holding company or its nonbank affiliates—he or she experiences no such conflict. Unaffiliated bank directors are therefore more likely to identify potential exploitation of the depository institution and resist predatory practices by the holding company.[182]

Similarly, requiring large banks to appoint unaffiliated directors would rationalize the United States’ regulatory framework for financial conglomerates. Recall that policymakers presume that a bank’s board zealously protects the depository institution from its nonbank affiliates.[183] For example, regulators entrust a bank’s directors to review and approve certain transactions with its affiliates, and they expect a bank’s board to dissent on the record—and even hire legal counsel—if its BHC takes advantage of the depository institution.[184] These safeguards, however, are effectively meaningless when a bank’s board overlaps with its BHC’s board. In that case, the bank’s board is unlikely to push back against the holding company’s board—since their members are one and the same. Requiring a bank to appoint unaffiliated directors, by contrast, would help the existing regulatory framework function as intended.

In addition, unaffiliated bank directors could serve as valuable points of contact for bank supervisors. As Professor Lev Menand has documented, the proliferation of financial conglomerates since the 1990s has corresponded with a concomitant decline in discretionary bank supervision.[185] Requiring unaffiliated bank directors could help to reverse the decades-long relaxation of bank oversight. Bank directors who are independent of their holding companies could function as unbiased points of contact for supervisors focused on safeguarding depositors and preventing the inappropriate expansion of the federal safety net. For example, supervisors could interview a bank’s unaffiliated directors as part of its annual examination and maintain consistent dialogue with the unaffiliated directors about any shortcomings. In return, unaffiliated directors might be more likely than dual BHC-bank directors to proactively seek out supervisors when the holding company jeopardizes the bank’s safety and soundness.

Some foreign countries already mandate that banks maintain directors who are unaffiliated with their holding companies. The United Kingdom, for example, requires that no more than one-third of the members of a large bank’s board of directors may be employees or directors of any of the bank’s nonbank affiliates.[186] Similarly, France prohibits a systemically important bank from sharing any directors with an affiliate that engages in proprietary trading or similarly risky financial activities.[187] Thus, other developed countries acknowledge the vital role that independent boards can play in safeguarding depository institutions from exploitation by their financial conglomerates.

Moreover, U.S. regulators have already mandated unaffiliated directors for certain insured depository institutions. In 2021, the FDIC adopted a rule establishing conditions for newly licensed industrial loan companies (ILCs)—a special type of depository institution that may be owned by a commercial parent company.[188] In the rule, the FDIC announced that it will require a new ILC to limit its parent company’s board representation to less than 50 percent of the ILC’s directors.[189] The FDIC explained that it adopted this safeguard “[i]n order to limit the extent of each [parent company’s] influence over a subsidiary industrial bank.”[190] This same logic, of course, could be applied to BHCs and their subsidiary banks. If such a rule is necessary to protect an ILC from exploitation by its parent company, a similar rule would be equally appropriate to prevent BHCs from taking advantage of their bank subsidiaries.

A requirement that large, diversified BHCs appoint unaffiliated bank directors would not be difficult for such firms to implement. Indeed, a few banks already have unaffiliated directors. A majority of Morgan Stanley Bank’s board members, for example, are otherwise unaffiliated with the bank and its holding company.[191] Likewise, most of Discover Bank’s board members are either employees of the bank or unaffiliated with the company.[192] In both cases, these banks have populated their boards with retired financial services executives, consultants, and other industry experts.[193] If policymakers were to mandate unaffiliated directors, other banks would likely appoint similar board members. An unaffiliated director requirement would probably not exhaust the pool of potential candidates, however, since the proposal outlined here would apply to only fourteen banks at present.[194]

An unaffiliated director mandate would also be straightforward for regulators to enact using existing legal authorities. The federal banking agencies have wide latitude to establish rules governing depository institutions’ safety and soundness.[195] The agencies could, for example, institute a requirement that large banks appoint unaffiliated members as part of their existing standards for bank boards of directors.[196] In contrast to proposals that aim to fix bank corporate governance problems by changing directors’ fiduciary duties, an unaffiliated director mandate could be accomplished through rulemaking and would not require amendments to state law.[197] In addition, permitting banks to appoint unaffiliated directors of their choosing would be less disruptive to traditional corporate governance norms than proposals requiring banks to name government or creditor representatives to their boards.[198]

While the agencies should require large banks to appoint unaffiliated directors, regulators probably do not need to mandate that such banks hire unaffiliated officers. With unconflicted directors in place, a bank’s board could be trusted to select suitable management to run the bank on a day-to-day basis. In some cases, such as when a BHC’s assets and revenues are concentrated in its bank subsidiary, it may be appropriate for the bank’s board to install the conglomerate’s senior executives as the bank’s leadership. In other cases, such as when the bank is a relatively small part of the broader holding company, a bank’s board may prefer to select officers who are unaffiliated with the bank’s holding company to prevent exploitation. Regardless, the selection of executive officers can reasonably be left to the board’s discretion, as long as unconflicted directors oversee the bank’s relationships with its affiliates.[199]

In sum, policymakers should strengthen bank governance to better protect depository institutions from exploitation by their affiliates. Requiring a large bank to appoint at least some directors who are unaffiliated with the bank’s holding company would alleviate conflicts of interest that facilitate the inappropriate expansion of the federal safety net. By mitigating these conflicts, an unaffiliated director mandate would ensure that someone is finally looking out for the banks.

B. Overcoming Implementation Challenges

To be sure, implementing an unaffiliated director mandate will require careful crafting to ensure the rule functions as intended. For example, policymakers will need to pay close attention to how unaffiliated directors are appointed, removed, and compensated. This Section examines several implementation challenges that warrant careful consideration but should not deter regulators from adopting an unaffiliated director mandate.

1. Appointment and Removal

First, policymakers must carefully consider how a bank appoints and removes its unaffiliated directors. Each of the largest U.S. banks is wholly owned by its holding company.[200] As the sole shareholder, the BHC may select and remove the bank’s directors at its discretion. This ownership structure therefore creates the risk that a bank’s unaffiliated directors will remain responsive to the BHC’s preference to expand the federal safety net.[201] Knowing that they could be removed by the BHC at any time, the unaffiliated bank directors will not want to “bite the hand that feeds them,” even if they are nominally independent of the BHC.

To address this concern, policymakers should require a bank or its holding company to provide notice to the bank’s primary federal regulator before appointing or removing an unaffiliated director. The agency could disapprove an appointment or removal if supervisors believe the proposal represents an attempt by the BHC to exert inappropriate influence over the bank’s board. At a minimum, when a bank proposes to remove an unaffiliated director, the regulator “may decide to scrutinise the relations between the [bank] and its parent company more rigorously.”[202] In turn, knowing that the parent company may incur regulatory costs for removing an unaffiliated director, those directors “may deem the threat by the parent company to use [its removal] power to be less credible than it would normally be.”[203] For these reasons, the United Kingdom requires a bank to obtain prior approval from the Prudential Regulatory Authority before appointing certain directors.[204]

The United States, in fact, already has a prior notice framework for bank personnel changes that could easily be adapted for this purpose. The Federal Deposit Insurance Act requires a bank to provide notice to its primary federal regulator at least thirty days before replacing any member of its board or hiring a new senior executive officer if the bank is undercapitalized or considered to be in “troubled” supervisory condition.[205] The responsible agency may disapprove a proposed personnel change if the agency finds that “the competence, experience, character, or integrity of the individual . . . indicates that it would not be in the best interests of the depositors of the [bank] or in the best interests of the public to permit the individual to be employed by, or associated with” the bank.[206] To adapt this framework for unaffiliated directors, the agencies could disapprove a notice if the relevant agency finds that the appointment or removal of an unaffiliated director could create or exacerbate conflicts of interest or compromise the bank’s independence. In this way, the agencies could help ensure that a BHC does not exert inappropriate influence over its bank’s board through the appointment and removal of unaffiliated directors.

2. Compensation

In addition to monitoring how unaffiliated bank directors are appointed and removed, policymakers must also pay attention to how such directors are paid. Financial conglomerates traditionally compensate senior officials, at least in part, with holding company stock or other equity-linked instruments.[207] If a bank pays its unaffiliated directors with holding company stock, however, these equity awards could bias the board members’ judgment. To the extent that a bank director owns a stake in the holding company, the director would have a financial incentive to allow the holding company to take advantage of the depository institution. The structure of bank directors’ compensation, therefore, could undermine the efficacy of an unaffiliated director mandate.

In response to this challenge, the banking agencies should establish standards for unaffiliated director compensation. Regulators could adopt several potential approaches to ensure that bank director compensation does not create conflicts of interest. For example, the agencies could require that banks pay their unaffiliated directors entirely in cash. Alternatively, the agencies could insist that banks compensate unaffiliated directors using the bank’s debt, which would better align the directors’ interests with the depository institutions’ creditors.[208] The banking agencies could incorporate standards for bank director compensation into their unfinished rulemaking to implement section 956 of the Dodd-Frank Act, which directs the agencies to establish regulations or guidelines “that prohibit any types of incentive-based payment arrangement” that “encourage[] inappropriate risks.”[209] The standards for bank director compensation need not be overly prescriptive—they simply need to ensure that the way in which banks pay their unaffiliated board members does not undermine their independence from the holding company.

3. Political Economy

Finally, proponents of an unaffiliated director mandate must confront political economy challenges. Why would the banking agencies—who have, to date, failed to adequately protect depository institutions from exploitation[210]—enact this reform?[211] And even if one set of regulators were to implement an unaffiliated director mandate, would other regulators roll it back in the future?

Although political-economy challenges pervade financial regulation,[212] an unaffiliated director mandate is likely the type of initiative that can be implemented and withstand future deregulatory efforts. Leadership of the federal banking agencies, of course, is not static over time. For example, it is widely expected that President Joe Biden’s nominees will be more aggressive on financial regulation than President Donald Trump’s appointees.[213] Reform-minded regulators are likely to find corporate governance initiatives easier to implement than substantive rules, such as capital and liquidity requirements, since governance reforms do not impose direct costs on financial institutions and may therefore be less objectionable to the industry.[214] Further, enactment of an unaffiliated director mandate could entrench the rule for the long-term. Future deregulatory efforts will likely focus on substantive rules that directly affect financial conglomerates’ profitability, rather than governance standards.[215] Even if the banking agencies were to weaken an unaffiliated director mandate in the future, financial conglomerates may decline to change their independent bank governance structures once they are in place.[216] Despite political economy challenges, therefore, if reform-minded regulators were to implement an unaffiliated director mandate, it would likely be a lasting reform.

Conclusion

Ever since the Gramm-Leach-Bliley Act authorized commercial banks to affiliate with nonbanks in 1999, financial conglomerates have had a powerful incentive to exploit their depository institution subsidiaries and take advantage of federal safety net subsidies. At present, however, no stakeholders in the U.S. financial sector have both the motivation and ability to reliably shield depository institutions from their parent holding companies. In particular, this Article has exposed an underappreciated conflict of interest that contributes to the inappropriate expansion of the federal safety net. While U.S. law expects a bank’s directors to zealously safeguard the depository institution from their nonbank affiliates, widespread overlaps between the boards of large, diversified BHCs and their subsidiary banks undermine bank directors’ ability to resist exploitation.

To prevent financial conglomerates from taking advantage of the federal safety net, policymakers could implement structural reforms, such as Professor Wilmarth’s proposal for a new Glass-Steagall Act.[217] In the absence of large-scale structural change, however, policymakers should look to an easy-to-implement corporate governance solution. Specifically, this Article has proposed that policymakers should require large banks to appoint directors who are unaffiliated with their holding companies or affiliates. An unaffiliated director mandate, if enacted, would mitigate conflicts of interest within financial conglomerates and thereby achieve some of the objectives of a new Glass-Steagall Act using existing legal authorities. Thus, as long as depository institutions are permitted to affiliate with other financial companies, this governance reform is essential to ensure that someone is finally looking out for the banks.

Appendix: Bank Directors

This Appendix lists the directors of the thirteen banks in the Article’s sample, as well as each director’s holding-company affiliation. The sample includes the lead bank subsidiaries of BHCs with more than $100 billion in assets and more than 1 percent of their assets in nonbanks.[218]

The Author compiled bank-board membership information from various state and international corporate registries, securities filings, and enforcement actions. The Author identified the bank directors’ holding-company affiliations from securities filings and other publicly available information. Data are current as of August 2021.

Bank directors’ holding-company affiliations are color-coded for ease of reference. The following Key explains the color-coding system. An individual with multiple roles in a BHC is classified by the individual’s highest position in the organization.[219]

| Key | ||

| Signal | Affiliation | |

| Italics | Bank director also serves as a director of the bank’s BHC. | |

| Dark Gray | Bank director is an employee of the bank’s BHC or a nonbank affiliate. | |

| Light Gray | Bank director is an employee of the bank. | |

| White | Bank director is otherwise unaffiliated with the bank and the BHC. | |

JPMorgan Chase & Co.

Total Assets: $3.69 trillion[220]

Nonbank Assets: 22.15%[221]

| JPMorgan Chase Bank N.A. – Board of Directors[222] | |

| Name | Role |

| Linda Bammann | Holding company director |

| Stephen Burke | Holding company director |

| Todd Combs | Holding company director |

| James Crown | Holding company director |

| James Dimon | Holding company director and CEO |

| Timothy Flynn | Holding company director |

| Mellody Hobson | Holding company director |

| Michael Neal | Holding company director |

| Phebe Novakovic | Holding company director |

| Virginia Rometty | Holding company director |

Bank of America Corporation

Total Assets: $2.97 trillion[223]

Nonbank Assets: 21.90%[224]

| Bank of America N.A. – Board of Directors[225] | |

| Name | Role |

| Sharon Allen | Holding company director |

| Susan Bies | Holding company director |

| Frank Bramble Sr. | Holding company director |

| Pierre de Weck | Holding company director |

| Arnold Donald | Holding company director |

| Linda Hudson | Holding company director |

| Monica Lozano | Holding company director |

| Thomas May | Holding company director |

| Brian Moynihan | Holding company director and CEO |

| Lionel Nowell III | Holding company director |

| Denise Ramos | Holding company director |

| Clayton Rose | Holding company director |

| Michael White | Holding company director |

| Thomas Woods | Holding company director |

| David Yost | Holding company director |

| Maria Zuber | Holding company director |

Citigroup Inc.

Total Assets: $2.31 trillion[226]

Nonbank Assets: 31.36%[227]

| Citibank N.A. – Board of Directors[228] | |

| Name | Role |

| Grace Dailey | Holding company director |

| Barbara Desoer | Holding company director |

| Jane Fraser | Holding company director and CEO, Citigroup |

| Sunil Garg | CEO, Citibank, N.A.[229] |

| Duncan Hennes | Holding company director |

| Peter Henry | Holding company director |

| S. Leslie Ireland | Holding company director |

| Diana Taylor | Holding company director |

| James Turley | Holding company director |

Wells Fargo & Company

Total Assets: $1.96 trillion[230]

Nonbank Assets: 10.88%[231]

| Wells Fargo Bank N.A. – Board of Directors[232] | ||

| Name | Role | |

| Mark Chancy | Holding company director | |

| Theodore Craver Jr. | Holding company director | |

| Maria Morris | Holding company director | |

| Richard Payne | Holding company director | |

| Juan Pujadas | Holding company director | |

| Charles Scharf | Holding company director and CEO | |

The Goldman Sachs Group, Inc.

Total Assets: $1.30 trillion[233]

Nonbank Assets: 84.54%[234]

| Goldman Sachs Bank USA – Board of Directors[235] | |

| Name | Role |

| Vikram Atal | Unaffiliated[236] |

| Kathryn Corley | Unaffiliated[237] |

| Carey Halio | Holding company deputy treasurer and head of investor relations; CEO, Goldman Sachs Bank USA[238] |