Open PDF in Browser: Todd Aagaard,* 24/7 Clean Energy

In the face of the rapidly escalating climate crisis, the electricity sector is moving toward renewable energy. To date, policies and strategies have focused on increasing overall renewable energy generation, with little regard for timing and location. The result has been a misalignment of supply and demand in renewable energy markets. Renewable power projects produce energy when and where it is least expensive, leaving supply scarce at other times and places. Consumers, meanwhile, continue to use power when and where they need it. This mismatch increases the electricity grid’s dependence on fossil fuel–fired electricity to meet electricity demand at times and places when renewable power remains scarce. For electricity consumers to escape their dependence on carbon-emitting energy sources, renewable energy markets must incentivize generation of power when and where people and businesses need electricity. Policies and strategies that employ the emerging concept of 24/7 clean energy can address the existing mismatch by aligning generation and usage on an hourly basis so that renewable energy meets the full electricity needs of the U.S. economy. This Article explains how existing renewable energy policies and strategies have created a mismatch between renewable energy generation and use; how that misalignment distorts renewable energy markets and impedes efforts to decarbonize the electricity sector; how 24/7 clean energy can address the misalignment problem; and how policies and strategies can support the development of 24/7 clean energy.

Introduction

Renewable energy policies and markets need a new direction. Facing an urgent imperative to reduce carbon emissions, the electricity sector is moving—but still far too slowly—toward renewable energy.[1] To succeed, policies and markets must create incentives for renewable energy that can meet the U.S. economy’s electricity needs whenever and wherever they arise, not just when and where renewable energy is cheap and easy to produce. To date, however, renewable energy policies and strategies have focused on increasing the overall amount of renewable energy generation, with little regard for timing and location.[2]

Existing renewable energy policies and markets thus treat renewable energy as largely fungible, allowing consumers to “use” renewable energy even if the renewable energy they purchase was generated months earlier or later and therefore could not have been the electricity the consumer actually used.[3] In part, treating renewable energy as fungible simply reflects the limitations of the electricity grid, which make it impossible to trace electricity from generator to consumer.[4] Once electricity is generated and transmitted to the grid, it becomes indistinguishable from all other electricity on the grid. Because the electricity itself cannot be tracked, a consumer cannot know whether the electricity they use comes from a renewable source.

To circumvent this tracking challenge, the electricity sector created the renewable energy certificate (REC). A REC is a commodity that represents the production of one megawatt-hour of electricity from a renewable energy source.[5] RECs allow suppliers and buyers of renewable electricity to trace their deliveries and purchases back to a verified renewable energy source, creating a market for renewable energy that operates in parallel with electricity markets.[6]

In addition to allowing tracking of renewable energy, and thereby creating a renewable energy commodity, RECs also give great flexibility to renewable energy purchases. Transacting the renewable generation attribute independently from the actual electric power enables electricity consumers to buy RECs without regard to the precise timing or location of generation. For example, a business using electricity on a hot summer day in Connecticut may be able to claim renewable energy usage by purchasing RECs generated on a winter night at a West Texas wind farm thousands of miles away. The consequence of a market that ignores the timing and location of renewable energy generation is thus a market in which supply and demand can be misaligned.[7]

This generation-use misalignment distorts renewable energy markets, undermining decarbonization. Ignoring the timing and location of generation leads purchasers to buy renewable energy when and where it is cheapest to produce, not necessarily when and where it is needed on the grid. This undervalues the renewable energy that actually meets the electricity needs of consumers, because neither policies nor the market currently require—or even allow—consumers to match the timing and location of the renewable energy they purchase to the timing and location of the electricity they use.[8] As a result, sources that produce at times and locations when renewable energy is scarce are undervalued in the market because they receive no premium for the scarcity of their product. Treating all renewable energy as fungible also overvalues renewable energy that is produced during periods of relative abundance.[9]

Without proper price signals, renewable energy markets fail to attract investment where it is most needed. Undervaluing scarce renewable energy perpetuates scarcity at times and places when renewable energy is more costly to produce. The grid, including renewable energy consumers, must rely on traditional fossil fuel energy to generate electricity at these times. The misalignment of renewable energy use and generation thus exacerbates the electricity grid’s reliance on fossil fuel generation and impedes the process of transitioning to clean energy.

If the electricity sector is going to decarbonize, renewable energy markets need to incentivize the generation of renewable power that is available when and where people need power. The emerging concept of 24/7 clean energy responds to this need by aligning renewable energy generation and use on an hourly basis.[10] Policies and strategies that employ 24/7 clean energy can align generation and usage so that renewable energy meets the full electricity needs of the U.S. economy. An electricity consumer who buys 24/7 clean energy would know that, for every kilowatt-hour of electricity they use, the same amount of renewable energy is being generated at the same time and in the same regional electricity market. Although not a cure-all for decarbonization, 24/7 clean energy offers an important opportunity to solve the existing misalignment of generation and use in renewable energy markets.

The idea of 24/7 clean energy is starting to catch on among some forward-thinking policymakers and large electricity consumers.[11] But both the misalignment problem and the 24/7 clean energy solution to it remain largely unrecognized and unexamined. This Article addresses that need, explaining how existing renewable energy policies and strategies have created a mismatch between renewable energy generation and use; how that misalignment distorts renewable energy markets and impedes decarbonization; how 24/7 clean energy can address the misalignment problem; and how policies and strategies can support the development of 24/7 clean energy.

This Article proceeds in four Parts. Part I briefly outlines the electricity sector’s decarbonization imperative. To avoid the most catastrophic consequences of climate change, our economy urgently needs drastic reductions in carbon emissions from the electricity sector and significant increases in electricity use as transportation and heating migrate away from fossil fuels. These efforts can only be accomplished through swift and massive increases in renewable energy.

Part II describes renewable energy markets. It provides a short primer on the electricity grid and electricity markets and then explains renewable energy policies and how renewable energy markets work. To date, these policies and markets have focused on maximizing overall renewable energy generation with only minimal attention to when and where such generation occurs.

Part III explains how renewable energy policies and markets, by ignoring the time and location of renewable energy generation, have created a misalignment between generation and use. Properly functioning markets use prices to send signals regarding scarcity or abundance.[12] Renewable energy markets largely ignore the timing and location of generation, which obscures the scarcity of renewable energy at particular times and places. Without proper price signals, the market does not incentivize the development of renewable energy when and where it is needed to meet demand.

Part IV contends that policies and markets would do well to adopt 24/7 clean energy strategies that correct the distortions noted in Part III by aligning renewable energy generation and use on an hourly basis. A 24/7 clean energy strategy creates incentives for developing renewable energy generation that can meet the full electricity needs of the American economy without support from fossil fuel generation. As renewable energy continues to grow its share of the electricity sector, 24/7 clean energy will need to play an increasing role in renewable energy purchases to accelerate decarbonization.

I. Renewable Energy and the Decarbonization Imperative

We are leading our planet down a path toward climate catastrophe. Human-caused carbon emissions have increased from pre-industrial baseline levels of nine million tons of carbon per year in 1750 to thirty-six billion tons per year in 2019—a four-thousand-fold increase.[13] These emissions have concomitantly increased levels of carbon dioxide in the atmosphere. Concentrations of atmospheric carbon dioxide are already 50 percent higher than pre-industrial levels and continue to rise.[14] More atmospheric carbon dioxide means higher temperatures. Human activities already have caused temperature increases of about 1 degree Celsius.[15] Even if emissions were to stop immediately, global temperatures may continue to rise for centuries into the future due to continued rising temperatures, thawing permafrost, and other physical processes already underway.[16]

The impacts of a disrupted climate are wide-ranging and serious. They include extreme temperatures, more frequent and severe droughts, extreme precipitation events, widespread loss of species and extinctions, increased wildfires, invasive species, rising sea levels, loss of polar ice, acidic and less oxygenic oceans, human heat-related illness and mortality, vector-borne disease, food insecurity, and coastal flooding and erosion.[17] These impacts do not just pose a future risk; many of them are already having dire effects.[18] Considerable uncertainty exists, however, regarding the timing, severity, and distribution of these impacts into the future.[19]

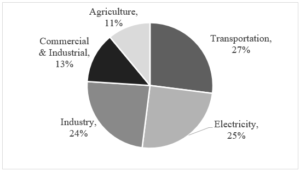

Despite some uncertainty about the impacts of climate change, an international consensus holds that global temperature increases must be limited to less than 2 degrees Celsius to avoid the most devastating scenarios.[20] To accomplish this goal will require reducing global carbon emissions to net zero by 2050.[21] A massive transformation of our energy economy from fossil fuels to carbon-neutral renewable energy is an essential component of a net-zero strategy.[22] As Figure 1 illustrates, the electricity sector accounts for 25 percent of total U.S. greenhouse gas emissions.[23] Effectuating a transformation to carbon-free energy thus means dramatically and rapidly expanding the generation of clean electricity from renewable resources. It also means generating substantially more electricity. This is because energy use for transportation, industry, and heating will need to shift from fossil fuels to electricity, which is more amenable to decarbonization.[24]

Figure 1: 2020 U.S. Greenhouse Gas Emissions by Economic Sector[25]

Pause now for a brief discussion of terminology. Strictly speaking, carbon-free and renewable energy are distinct concepts. Carbon-free, carbon-neutral, or clean electricity are essentially synonymous terms that refer to electricity generated through processes that do not emit carbon.[26] Renewable energy comes from naturally replenishing sources.[27]

The two categories—carbon-free electricity and renewable energy—incompletely intersect. Some generation resources such as hydropower, solar, wind, and geothermal are both carbon free and renewable.[28] Nuclear power is carbon free but is not renewable because it uses mined uranium that is not naturally replenishing.[29] Whether renewable biomass should count as carbon neutral has caused controversy.[30] Even electricity generation classified as clean or carbon free is not completely carbon neutral, as construction and operation of even the cleanest generation facilities produce some carbon emissions.[31] Meeting the decarbonization imperative described in Part I will require quickly shifting energy use to clean energy sources, including renewable energy.

II. Renewable Energy Markets

Both governments and electricity consumers are gradually responding to the urgent need to meet the decarbonization imperative by taking actions to increase the use of renewable energy. To date, however, these actions have largely centered on strategies for increasing renewable energy without regard to when or where it is generated.[32] The result has been an increasing misalignment of renewable energy generation and usage.[33] This Part examines the existing structures for purchasing renewable energy in the United States—the electricity grid, electricity markets, RECs, and renewable energy transactions—and how they create the conditions that lead to the misalignment problem.

A. Electricity Grid Basics

Electric power is generated, transmitted, and distributed through the electricity grid, a massive network of power plants, high-voltage transmission distribution lines, substations, transformers, low-voltage distribution lines, and other equipment.[34] The grid is a complex network that delivers power to electricity consumers ranging from large institutions and industrial facilities to small businesses and residences.[35] Power plants generate electric power, which is then transmitted over high-voltage power lines to communities where it is distributed over local lines to end users.[36]

Three phases in the electricity supply chain—generation, transmission, and distribution—thus comprise the grid. Generators create electric power from a variety of sources including natural gas, coal, nuclear, hydroelectric, biomass, wind, and solar.[37] Networks of transmission and distribution lines comprise regional power grids, also known as interconnections.[38] The continental United States and Canada encompass four distinct interconnections: the Western Interconnection, the Québec Interconnection, the Eastern Interconnection, and Texas.[39] Although some limited transfers of power occur between interconnections, for the most part, each interconnection operates independently.[40]

Once electricity is generated and enters the grid, it becomes indistinguishable from all other electricity in the grid.[41] An electricity consumer, therefore, does not know the actual source of the electricity they use. Nor is an electric utility that sells the electricity to the consumer able to track electricity from a particular generator to specific customers. Instead, the utility generates—or purchases from a generator—enough electricity to meet its customers’ demand and allows each customer to use that quantity of electricity pulled from the grid.[42]

Some energy experts thus have likened the grid and electricity markets to a bathtub.[43] Generators add electricity to the grid like adding water to a bathtub.[44] Consumers take electricity from the grid like removing water from the bathtub.[45] No consumer can trace its electricity to any generator, as the electricity—like water in a bathtub—is fungible.[46] Unlike a bathtub’s ability to store water, however, the electricity grid currently has almost no ability to store electricity.[47] The grid’s system operators, therefore, must ensure that supply and demand of electricity are constantly in balance to avoid costly and even dangerous power outages and equipment damage.[48]

Electricity travels at close to the speed of light, so electric power moves within the grid almost instantaneously from generation through transmission and distribution to end use.[49] Moreover, as noted, electricity is difficult to store in significant quantities.[50] Together, this means that electricity supply from generators must constantly meet electricity demand from consumers to keep the grid in balance.[51] This is exceedingly complicated, as demand for electricity varies greatly by the season, the day, and even the time of day.[52] To meet this variable demand, grid operators rely on a diverse fleet of power plants. Some power plants, historically known as baseload plants, operate at low cost virtually all the time, producing a constant output of power.[53] Coal, nuclear, and some combined-cycle natural gas turbine plants tend to operate as baseload plants.[54] Other power plants, known as peaker plants, are able to come online and offline more rapidly but at higher cost. Grid operators use peaker plants to produce power during periods of peak demand—hence their name.[55] Most peaker plants operate on natural gas, although some operate on oil.[56]

Some renewable energy sources, such as geothermal and hydroelectric plants, can operate as baseload plants relatively constantly and at low variable cost.[57] But other, more intermittently available renewable energy sources—most notably wind and solar—do not fit neatly into either category of baseload or peaker.[58] Because they have no fuel costs (wind and sunlight are free, unlike coal or natural gas), wind and solar resources produce power at very low variable cost. Accordingly, unlike peaker plants, once constructed, wind and solar resources are economical to operate at almost any level of electricity demand and can compete with traditional baseload plants.[59] But because the wind is not always blowing and the sun is not always shining, wind and solar power are not always available on demand, so it is more difficult for them to reliably provide either baseload power or power to meet peak demand.[60] As electricity storage technology continues to develop and storage costs fall, more storage will be constructed, and variable renewable energy sources operating in conjunction with storage will be more able to meet electricity demand with reliable supply.[61]

In sum, regional electricity grids operate according to certain principles. Electricity within the grid is fungible and cannot be traced. Supply must always meet demand. Until the grid develops more storage capacity, the timing of electricity generation and use must match precisely. These principles set the parameters for electricity markets—and also create the genesis of the misalignment of renewable energy generation and use.

B. Electricity Markets

Electricity markets are not typical product markets, and they never have been. The electricity sector in the United States developed in the early twentieth century around vertically integrated monopoly utilities.[62] These utilities owned the generation, transmission, and distribution facilities within a defined service area and sold their electric power to end-use consumers at state-regulated rates.[63] Consumers had essentially no choice about the electricity they purchased from the monopolist utility.[64] This traditional form of electricity regulation still exists, with some modifications and variation, in large parts of the United States, especially the West (excluding California) and Southeast.[65]

However, in the late 1990s and early 2000s, some regions of the country adopted competitive electricity markets to displace the regulated monopoly model through a process known as restructuring.[66] In states with restructured electricity sectors, independent generators sell their power to electric utilities and other electricity suppliers in organized wholesale markets.[67] The suppliers then sell the power to end users in the retail market.[68] Some states have restructured their electricity sector to have competitive wholesale and retail markets, allowing end users to choose their electricity supplier.[69] Many states, however, have adopted competitive wholesale markets but continue with more traditional, state-regulated monopolies at the retail level, forcing consumers to purchase their electricity from their designated electricity distribution company.[70]

States thus have one of essentially three types of electricity markets: traditionally regulated, competitive wholesale market and traditionally regulated retail market, or competitive wholesale market and competitive retail market.

Well-functioning markets are able, by settling at an equilibrium price that balances supply and demand, to attach a value to a product that appropriately reflects its relative scarcity of supply as compared with demand.[71] Electricity markets, however, perform this function poorly.[72] Vertically integrated public utilities in traditionally regulated states operate without competition, and prices are set administratively by state public utility commissions.[73]

Where wholesale electricity markets are competitive, they do a reasonable job of valuing electric power consistent with economic principles. In particular, because electricity demand varies greatly—by the season, the day, and even the time of day[74]—the scarcity of electric power varies greatly as well. Wholesale electricity markets respond accordingly, with significant volatility in prices.[75] In addition to reflecting temporal differences in scarcity, electricity prices in competitive markets also reflect differences in scarcity by location. Although wholesale electricity markets often encompass large territories covering multiple states, transmission constraints can lead to more localized scarcity (or abundance) within a market.[76] Competitive markets employ a wholesale pricing system known as locational marginal pricing to vary local prices so that they reflect the balance of supply and demand.[77] Thus, wholesale electricity markets in competitive markets vary temporally and locationally to reflect the balance of supply and demand in the market. This facilitates proper valuation of electric power in the marketplace, which in turn creates effective incentives to provide power at the times and places that create value for the consumer.

C. Renewable Energy Purchases

If the electricity grid is going to decarbonize in time to avoid a climate catastrophe, renewable energy generation and use will have to assume dominant roles in overall electricity generation within a short period of time. Assessed against this objective, existing renewable energy generation exhibits two very different patterns, one sobering and one more hopeful.

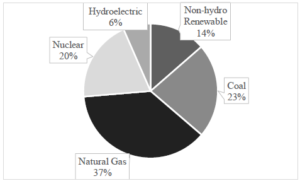

On the sobering front, electricity generation from renewable energy remains low compared with fossil fuel generation.[78] Figure 2 illustrates electricity generation in the United States by fuel source for 2021.[79] Non-hydropower renewable generation accounted for just 14 percent of total U.S. electricity generation.[80] The United States generates five times more electricity from coal and natural gas than from wind and solar.[81]

Figure 2: 2021 U.S. Electricity Generation by Fuel Source[82]

On the more hopeful front, renewable energy generation is increasing dramatically, both in absolute terms and as a share of total electricity generation. Total electricity generation in the United States has held relatively steady over the last decade at levels slightly less than 4,000 terrawatt-hours.[83] Non-hydropower renewable energy generation, however, has increased 339 percent since 2010—from 139 terrawatt-hours in 2010 to 536 terrawatt-hours in 2021.[84] The share of total electricity generated from renewable sources thus has risen from 3.5 percent in 2010 to 13.5 percent in 2021.[85] Electricity generation from renewable energy sources including hydropower (20 percent) almost equals, and sometimes even exceeds, generation from coal (23 percent).[86]

The disparity between these two trends—the continuing dominance of traditional fossil fuel–fired generation, but the rapid rise of renewable energy generation—illustrates an important feature of the electricity sector. Because power plants generally operate for decades, most currently operating generation facilities that contribute to overall generation capacity were constructed many years ago.[87] New power plants in 2021 accounted for about forty gigawatts of generation capacity,[88] as compared with overall system generation capacity of approximately one thousand gigawatts.[89] Non-hydropower renewables were 70 percent of new capacity,[90] but only 16 percent of total capacity.[91] Even with renewables continuing to account for a large portion of new generation, and even at current rates of rapid growth, it still would take decades for renewables to contribute a majority of electricity generation in the United States.[92]

Much of the growth in renewable energy generation has resulted from mandatory state purchasing requirements known as renewable portfolio standards or clean energy standards.[93] Renewable portfolio standards are state laws that require electric utilities and electricity suppliers to secure a designated portion of the electricity they sell to consumers from renewable sources.[94] Clean energy standards apply the concept of renewable portfolio standards to renewable and other zero-carbon energy sources, often in conjunction with ambitious targets such as 100 percent clean energy by 2045.[95] Because renewable portfolio standards and clean energy standards operate similarly with respect to renewable energy markets, for ease of reference, this Article will use the term renewable portfolio standards to encompass both types of requirements.

States adopt renewable portfolio standards with the objectives of reducing pollutant emissions, increasing diversity and security of energy supply, stabilizing power prices, and spurring local economic development.[96] Purchases of electricity by electric utilities to meet obligations imposed by renewable portfolio standards are known as compliance demand.[97] As Figure 3 illustrates, compliance demand accounts for a majority of electricity sold from renewable sources.

Figure 3: 2010–2020 Voluntary and Compliance Renewable Energy Purchases[98]

As Figure 3 also illustrates, voluntary demand has increased both in absolute terms and as a proportion of overall renewable energy purchases. Voluntary demand has increased from approximately one-quarter of overall renewable energy–generated electricity in 2010 to approximately one-third in 2020.[99]

Electricity consumers voluntarily choose to purchase renewable energy for a variety of reasons, including but not limited to decarbonization goals.[100] Renewable energy creates other environmental benefits as well, including reducing emissions of air pollutants—such as sulfur dioxide, nitrogen oxides, and particulate matter—and reducing water use.[101] Other major motivations include reputational benefits and costs.[102] Buying renewable power can, for example, create positive publicity and enhance the reputation of a corporate purchaser.[103]

The cost advantages of renewable power are particularly important, and a relatively recent development. Between 2010 and 2020, the cost of wind power decreased by approximately 70 percent, and the cost of solar power decreased by approximately 85 percent.[104] Wind and solar are now, on a levelized cost basis, less expensive than gas or coal power.[105] Low costs have become a key driver of growth in renewable energy.[106] In addition to sometimes providing a low-cost source of electricity, renewable energy also provides cost stability.[107] Because the energy inputs of renewable technologies such as wind and solar are either stable or decreasing, renewable energy reduces price volatility and enables more accurate financial predictions for power use.[108]

Renewable energy is expanding rapidly but still only accounts for a small portion of the overall electricity market. If renewable energy generation is going to grow at a pace necessary to meet the decarbonization imperative, purchases of renewable energy will have to accelerate even more rapidly than they have been. The declining costs of renewable energy will stimulate growth, but more is needed. This will require new and innovative strategies.

D. Renewable Energy Certificates

Consumers who want to use electricity from renewable sources face a major practical obstacle that is inherent to the grid. As noted above,[109] because electric power is fungible on the grid,[110] it is impossible for consumers to distinguish renewable energy from other electricity. As a result, electricity delivered through the grid cannot be traced to its source, and no electricity consumer can know the origin of the electric power that they use, including whether that power was generated from a renewable source.[111]

RECs respond to this problem.[112] RECs track electricity generated from renewable sources. Because electric power itself cannot be traced to its source once it is generated and delivered to the grid, RECs provide a transferable record of the renewable attribute of power.[113] Each REC represents one megawatt-hour of electricity generated from a renewable source.[114] To create a REC, a renewable energy generator reports data about its production to a tracking system.[115] The data reported to tracking systems include the quantity of power generated from the renewable energy facility as well as other attributes such as the date of generation, generator location, any emissions, fuel source, and the date the generator started operation.[116]

Based on the data the tracking system receives from the generator, the tracking system issues RECs for the renewable power that has been generated.[117] Each REC has its own unique serial number to track certificates and to ensure that renewable energy is claimed just once by electricity consumers.[118] Once the tracking system issues a REC to the generator, the generator can transfer the REC to another entity, such as an electric utility, that can then claim the use of renewable energy.[119] The tracking system records transfers of RECs, which avoids uncertainty about ownership and again prevents double counting.[120] Electricity suppliers or consumers that want to claim renewable energy use acquire RECs and then retire them, which terminates claims to those RECs and maintains the exclusivity of claims to renewable energy use.[121]

The REC system allows the electricity sector to track renewable energy purchases and, because RECs are defined as an attribute separate from the electric power itself, allows generators to sell RECs separately from their power.[122] RECs thus can be transferred either with electricity (bundled) or separate from electricity (unbundled).[123] As long as each REC reflects actual renewable energy generation and is only claimed once, each REC effectively serves as a measure of renewable power regardless of whether the REC is bundled or unbundled with the transfer of electricity.[124] The key to a REC is therefore its ability to convey an exclusive contractual right to claim the renewable energy attribute of electricity generation.[125] Once the renewable attributes of electricity are embodied in a REC, the power itself becomes irrelevant to accounting for use and delivery of renewable energy on the grid. Indeed, creating the REC effectively strips the generation attributes from the power.[126] An acquirer of a REC then later reattaches the renewable attributes to the power it uses, allowing it to assert a legitimate claim that it uses renewable energy.

To illustrate how RECs work, consider the following hypothetical examples:

- Business A purchases electricity from an electric utility and wants to use renewable power. If Business A uses twenty megawatt-hours of electricity annually, it can purchase an equal quantity of RECs—that is, twenty—and then validly claim to use renewable energy. Although Business A has no ability to know whether the electricity it uses actually originated from a renewable source, it can claim twenty megawatt-hours of renewable energy by virtue of its procurement of twenty RECs.

- Business B enters into a power purchase agreement whereby it buys its electricity directly from a wind power project. In addition to purchasing electricity from the wind project, Business B also purchases an equal quantity of RECs from the same project. Because the power and RECs are contractually transferred together, the RECs are bundled. The wind project delivers power to the grid, and Business B uses power from the grid. Business B has no way of knowing whether the power it draws from the grid is the same power that the wind project delivers to the grid.[127] But because Business B purchases a quantity of RECs equal to the quantity of electricity it uses, it can claim to use renewable energy.

- Business C enters into a power purchase agreement whereby it buys its electricity directly from a wind power project. Unlike Business B, Business C does not purchase RECs from the wind project. Instead, the wind project sells its RECs to Business D, which purchases its power from its utility. The RECs are therefore unbundled because they are not transferred with the electric power. The wind project delivers power to the grid, and Business C uses power from the grid. Because Business C purchases only electricity, and not RECs, it cannot claim to use renewable energy—even though it purchases its electricity from a renewable source.[128] Business D, however, can claim to use renewable energy, even though it purchases its electricity from its utility. This is because Business D, by virtue of its acquisition of RECs, has the exclusive right to claim use of the renewable energy attribute associated with those RECs.[129]

For the REC system to operate effectively, two conditions must hold: (1) each REC must reflect actual generation of electric power from a renewable energy source, and (2) only one electricity consumer can claim each REC.[130] When these two conditions are met, claims to use renewable energy will match the amount of electric power generated from renewable sources. This is true even though renewable energy markets neither track the consumer’s power use to the renewable energy source nor attempt to match the timing of the consumer’s power use with the timing of the renewable energy source’s generation. Separating the renewable energy attribute from the power in RECs both enables the formation of renewable energy markets and creates the conditions that have led to the misalignment of generation and use in those markets.

E. Demand in Renewable Energy Markets

Renewable energy markets move in response to changes in supply and demand. Renewable energy will expand if demand increases due to regulatory mandates and voluntary preferences, if supply increases due to lower costs, or both. On the supply side, conditions seem highly favorable for strong growth of renewable energy. The costs of renewable energy have plummeted in recent years[131] and are projected to continue to decline.[132] The future trajectory of renewable energy markets therefore depends, in great part, on what happens to demand for clean electricity. Demand for renewable energy derives from both regulatory requirements of renewable portfolio standards (compliance demand) and voluntary demand.

1. Compliance Demand

Compliance demand comes directly from renewable portfolio standards in which states set quotas requiring electric utilities and other electricity suppliers to generate or purchase certain quantities of renewable energy. Thirty states plus the District of Columbia and three territories have established renewable portfolio standards.[133] Renewable portfolio standards express their purchase quotas as a percentage of total electricity use in the state[134] or, in a few states, in terms of a required amount of electricity generated from renewable sources.[135] Each state defines its own eligibility requirements for what electricity counts toward meeting the standards based on certain attributes, such as the type of generation source.[136] Some states further divide these eligible facilities into subcategories, often called tiers, with different purchasing quotas for each subcategory.[137] States adopt these tiers to promote the development of specific types of renewable energy, such as distributed generation or solar.[138] Utilities and suppliers that are subject to the purchasing quotas must pay an alternative compliance payment for any shortfalls.[139]

Once a state has established its renewable portfolio standards, compliance demand for RECs follows rather straightforwardly. Two simple principles would be expected to guide compliance demand, each based on the fact that compliance demand exists to meet a regulatory mandate. First, electric utilities and electricity suppliers subject to a renewable portfolio standard will comply with the regulatory mandate to purchase renewable energy as long as the price for RECs does not exceed the alternative compliance payment.[140] Second, electric utilities and electricity suppliers buying RECs to satisfy a renewable portfolio standard will seek out the lowest-cost RECs that meet the requirements of the standard. If, for example, a renewable portfolio standard defines both solar and wind power to count equally toward meeting the quota, then the compliance purchaser will be indifferent between RECs generated from solar power and RECs from wind power, choosing the available option with the lowest cost.

2. Voluntary Demand

Voluntary demand operates differently than compliance demand. Instead of facing a regulatory mandate that dictates much of their purchasing decisions, voluntary purchasers themselves decide whether, how much, and what types of renewable energy to buy based on their own assessment of tradeoffs between the benefits and costs of purchasing renewable energy.[141] Certification systems impose some limits on voluntary REC transactions,[142] but voluntary purchasers generally exercise significantly more discretion in their purchases than compliance purchasers. Although there is no definitive data available, evidence suggests that many electricity consumers are looking to leverage the effects of their renewable energy purchases to advance decarbonization.[143]

Electricity consumers in theory have several different options for purchasing renewable power, although not every option may be available to every consumer. First, some electricity consumers can generate electricity from on-site renewable sources, such as solar panels or wind turbines.[144] Second, large and sophisticated electricity consumers can enter into long-term bilateral contracts, known as power purchase agreements, in which they purchase electricity and RECs directly from a renewable energy project.[145] Third, any electricity end user can purchase standalone RECs and self-bundle those RECs with electricity the end user purchases through its regular channels.[146] Fourth, some electric utilities offer renewable energy products known as green tariffs that bundle RECs and power for sale to consumers.[147] Fifth, community-based structures exist and account for a small but significant and rapidly growing portion of renewable energy purchasing.[148] Instead of leaving renewable energy purchases to individual families or businesses, these options allow communities to organize to find their own sources of renewable power and to negotiate favorable prices for the power.[149]

Despite the variety of attributes that these different purchasing options present, they share at least two common features relevant here. First, although each option has its relative advantages and disadvantages for different profiles of electricity consumers, every option ultimately relies on renewable energy markets. Even on-site generation almost never replaces an electricity consumer’s reliance on the grid. Very few electricity consumers are able to rely solely on on-site generation to meet all their electricity needs; instead, the consumer becomes both a producer and consumer of grid electricity—sometimes known as a prosumer.[150] Second, because these purchasing options operate through renewable energy markets, which, as explained above, do not attempt to match the timing and location of generation, none of these purchasing options actually match generation and usage. This allows misalignment between renewable energy generation and use.

3. Temporal and Geographic Constraints

Although existing renewable energy markets do not attempt to match generation and use, they do impose some temporal and geographic constraints on renewable energy purchases, establishing a very leniently approximated connection between generation and use. For compliance purchases, these constraints are contained in the requirements of renewable portfolio standards.[151] For voluntary purchases, the constraints are set forth in the standards of renewable energy certification organizations.[152] Both types of requirements limit the geography and timing in which RECs can be used to cover electricity use so that, for example, a U.S. electricity consumer or utility in 2021 cannot claim renewable energy usage based on RECs created in Europe in 2015. Thus, the requirements fall into four categories: temporal constraints on compliance purchases, temporal constraints on voluntary purchases, geographic constraints on compliance purchases, and geographic constraints on voluntary purchases. But although the details of the requirements in each category differ, across the board these constraints are very lenient and do not attempt meaningfully to match renewable energy generation and use.

State renewable portfolio standards often impose geographic limits on what RECs can be used to satisfy the particular state’s mandate. Connecticut’s renewable portfolio standard, for example, requires purchases of RECs generated within the New England regional grid or adjacent control areas.[153] Pennsylvania’s standard requires purchases from within the PJM Interconnection, which operates the electricity grid in all or parts of thirteen mid-Atlantic and Midwestern states.[154] Thus, both these states limit REC transactions to within the territory of a regional transmission organization. These limitations make it at least theoretically possible that the consumer claiming the REC uses electricity actually provided by the generator that created the REC.

Some states allow a broader range of transactions. Minnesota, for example, allows purchases from anywhere within the Midwest Renewable Energy Tracking System (M-RETS) and Michigan Renewable Energy Certification System (MIRECS), which collectively encompass fifteen states plus the Canadian province of Manitoba.[155] M-RETS even includes RECs generated in Texas, which is not interconnected with Minnesota and not part of the same wholesale electricity market.[156] Here, the primary motivation for the geographic limitations seems to be the verification of the renewable energy generation rather than the location of the generation.[157]

For voluntary purchases, renewable energy certification standards impose geographic constraints, generally limiting REC transactions to the same “market.”[158] That constraint has been defined by a somewhat complex combination of regulatory consistency and the physical interconnectedness of the grid.[159] Generally, international trading has not been considered appropriate unless the two countries have both regulatory consistency and physically interconnected grids, such as the United States and Canada.[160] Thus, a U.S. electricity consumer would not be able to claim a REC associated with generation in Norway, even if the Norwegian certificate was otherwise valid and consistent with U.S. standards.[161] A U.S. electricity consumer may, however, be able to claim a REC associated with generation in certain parts of Canada because of the physical interconnections between the Canadian and U.S. grids and regulatory consistency in their standards for RECs.[162] Within a country under a common regulatory framework, trading is generally allowed even in the absence of a physical interconnection.[163] Thus, many U.S. electricity consumers claim renewable energy use based on RECs from Texas wind generation, even though the Texas grid is separate from the rest of the United States.[164] Allowing such trading means that electric power can be counted as renewable even if it is clear that the renewable power that formed the basis for the claim was generated in a location unconnected to the location at which the electricity was used. Thus, a consumer can claim renewable energy use through a REC generated from a renewable project that physically could not have provided the electricity the consumer used.

Geographic constraints on REC purchases, especially those for compliance purchases, segment the national market for renewable energy. Thus, for example, because Pennsylvania’s Alternative Energy Portfolio Standards require electricity to come from projects located within the PJM Interconnection service territory,[165] a Pennsylvania utility subject to the Pennsylvania Standards must buy renewable energy from projects located within the PJM territory. As a result, compliance demand for renewable energy projects in Pennsylvania will differ from compliance demand in a state outside of PJM territory, such as Colorado, which has its own renewable portfolio standard.[166] Similarly, because the Pennsylvania Standards impose specific quotas for solar energy, compliance demand for electricity from solar power will also differ from compliance demand for electricity from wind power. Thus, although compliance demand follows directly from the regulatory mandates of renewable portfolio standards, differences across state standards and within standards create segmented and differentiated submarkets for categories of renewable energy.

Certification standards for voluntary purchases and renewable portfolio standards for compliance purchases manage the temporal dimension of RECs through what are known as vintage limitations that restrict when a REC can be used.[167] Again, the constraints are extremely lenient for both voluntary and compliance purchases. For example, under the Green-e system for voluntary purchases, a REC must be sold within a twenty-one-month window from the time of generation to create the basis for a valid claim of renewable energy use.[168] The RE100 Climate Group does not recommend a specific vintage limitation but instead says a REC should be used at a time “reasonably close” to the year in which the REC was created.[169]

Temporal constraints are quite relaxed for compliance purchases as well. State policies embedded in renewable portfolio standards impose timing requirements of various lengths generally ranging from one year to several years.[170] Some state policies do not specify any vintage limitations.[171] Vintage limitations thus make no real attempt to match the time of generation to the time of usage for either voluntary or compliance purchases. This is a major gap because precise timing is fundamental to the operation of the grid.[172] In the absence of significant increases in electricity storage, renewable energy generated one day cannot be used even later the same day, let alone later the same year.

If the goal is to wean the grid from its dependence on carbon-emitting electricity generation, then existing geographical and vintage limitations impose only very weak constraints on renewable energy purchases and do not align renewable energy generation to electricity use. A REC created when a Texas wind farm generated a megawatt of electricity in 2020 could form the basis for a claim to renewable energy for a megawatt of electricity used by a business in Pennsylvania in 2021, even though the Texas turbine generated its electricity during a different season, year, and electricity market than the electricity the Pennsylvania business used. In other words, there is no possibility that the Pennsylvania business could have used the 2020 Texas electricity in Pennsylvania in 2021. In the end, traditional REC transactions only match the quantity of electricity that consumers are claiming as renewable to the quantity of electricity actually generated from renewable sources. REC transactions make very little effort—only very broad limitations on time and location—to establish actual linkage between electricity generation and usage. This lack of linkage leads to a misalignment between generation and use.[173]

F. Renewable Energy Revenues

New renewable energy projects to meet the decarbonization imperative will only be constructed if project developers and their investors anticipate that the projects will earn sufficient revenues to cover their costs. Demand for renewable energy, the subject of the preceding Sections, thus plays an important role in driving renewable energy development because it creates revenue for renewable energy projects. Revenues accrue to projects from sales of power, sales of RECs, and tax incentives. But these revenues are not monolithic. Different revenue streams have varying effects on renewable energy project development because they have multiple possible implications for project viability and create particular incentives for projects. It is a significant shortcoming of renewable energy markets that most project revenues do not reflect the value of how well a project meets the renewable energy needs of electricity purchasers, contributing to the misalignment problem.

First, renewable projects earn revenue from selling electric power. Renewable energy projects sell their electricity in wholesale electricity markets in restructured states and directly to investor-owned utilities in traditionally regulated states.[174] Projects can sell their power in spot markets, which are held the day before or the day of delivery, or through power purchase agreements.[175] Instead of—or in some cases, in addition to—selling their power, projects also can sell their availability into other types of electricity markets known as capacity markets and ancillary services markets.[176] In any of these markets, the price at which power is sold reflects the balance of supply and demand of power generally, not the availability of renewable power in particular. In other words, the price at which a renewable energy project can sell its power depends on the supply and demand for power, not on the supply and demand for renewable energy. Power markets do not attach value to the renewable attribute of power. This is of practical necessity because electricity is untraceable on the grid and by design because the renewable attribute of power is embodied separately in RECs.[177] The value of the renewable attribute should be embodied in the price of the associated RECs.

Second, the sale of RECs constitutes an additional revenue stream for renewable energy projects.[178] Depending on the price at which a developer can sell the RECs for a project, revenue from RECs may range from crucial to insignificant for project financing. Some analyses, for example, suggest that REC revenue may account for anywhere from 1 percent to 45 percent of total revenue from a renewable energy project—an enormous difference.[179] Existing REC markets do not attempt to align the time and location of renewable energy generation and use, instead imposing only very lenient restrictions on when and where RECs are generated.[180] Thus, the revenue from RECs does not create an incentive for projects to get built or to generate power at times and in locations at which renewable energy is most scarce, contributing to the misalignment problem.

Third, the financing of renewable projects may benefit from tax incentives. Tax incentives help to bridge the gap between project costs and revenues and can play an important role in determining the financial viability of a project.[181] Various federal, state, and local tax incentives have been available for renewable energy projects, including production tax credits for the production and sale of electricity from renewable sources, investment tax credits for capital costs of a renewable project, sales and property tax exemptions, and tax abatements.[182] These tax incentives reduce the costs of renewable energy, making renewable energy projects financially viable at lower levels of revenue or higher costs.[183] In addition, the renewable energy sector has developed several structures to monetize these tax incentives.[184] These structures, which include partnership flips, sale leasebacks, and pass-through leases, compensate renewable project investors in part by allocating the project’s tax credits to the investor.[185] In this way, the tax incentives effectively become a substitute for the project revenues that are otherwise needed to compensate lenders and investors. Again, like power market revenues and REC revenues, tax incentives do not attempt to value renewable energy based on how well it matches the time and location of renewable energy use. Some tax incentives, such as investment or real estate tax credits, are not tied to power output at all.[186] Even the production tax credit, which is tied to power output, treats power output uniformly, without regard to whether the timing and location of generation aligns with renewable energy use.[187]

In sum, renewable energy projects benefit from several different revenue streams. But none of these revenue streams attempts to differentiate renewable energy so that the markets can value renewable energy generation based on timing or location.

III. Generation-Use Misalignment

Every megawatt-hour of renewable energy purchased in the market, whether mandated by a renewable portfolio standard or procured voluntarily, contributes in some amount and in some way to decarbonization by shifting electricity use from fossil fuel–based generation to less carbon-intensive energy sources.[188] The more consumers purchase renewable energy, rather than electricity from nonrenewable sources, the more renewable energy will be generated. Supply will increase to meet rising demand.

But renewable energy markets can do much better in facilitating the transition to decarbonization. In particular, renewable energy policies, standards, and procurement strategies currently create a misalignment of renewable energy generation and use by not trying to match the time and region of renewable energy use with the time and region of renewable energy generation.

Allowing REC transactions with little regard to alignment of time and location made some sense, especially in the early stages of renewable energy development. An unaligned REC market has some benefits. Because it treats all RECs as essentially fungible, it minimizes transaction costs and allows market competition among sellers that drives down prices, thereby minimizing the overall cost to consumers.[189] Thus, in some respects ignoring differences among RECs allows the renewable market to function well as a market. And if renewable energy demand is at all price responsive—that is, if electricity consumers purchase more renewable electricity if it is cheaper and less when it is more expensive—then migrating purchases to low-cost options also will tend to increase the overall quantity of renewable energy purchased. All of that seems good.

But an unaligned market has its limits, and those limits are becoming increasingly apparent as renewable energy matures in its role in electricity markets. First, an unaligned market does not accurately value renewable energy. With solar and wind power now cost competitive with other sources of electricity generation,[190] renewable power is becoming plentiful at times and locations in which solar or wind energy is abundant. Renewable power is sometimes even becoming overabundant—more is available than is needed.[191] But at other times, renewable power is still scarce. A well-functioning energy market, like any market, should value a product based on the product’s relative scarcity or abundance.[192] Scarcity should lead to higher prices, and higher prices will draw investment, growing supply to alleviate the scarcity.

Treating RECs as fungible by ignoring time and location hides renewable energy scarcity at certain times and places, which dampens price signals.[193] Inadequate price signals impair the ability of renewable energy markets to draw investment to construct renewable energy sources and storage facilities that can release power to the grid during times and at locations in which renewable power is scarce. The misalignment of renewable energy generation and usage thus creates a distortion in renewable energy markets. The natural consequence of flexibility that allows misaligned renewable energy purchases is the concentration of purchases on times during which renewable energy is plentiful and therefore available at lowest cost. A well-functioning market, by contrast, should yield a higher price at times when supply is limited and a lower price at times when supply is abundant. As long as this mismatch is ignored, renewable energy markets will gravitate toward low-cost options such as wind power in western Texas and solar power in California—regardless of what this supply contributes to renewable energy use. There is nothing wrong with this low-cost development, but it will not come close to meeting the economy’s full electricity needs. Meanwhile, the absence of higher prices during periods of renewable energy scarcity undervalues projects and technologies that could produce power during those periods.

Second, an unaligned renewable energy market that does not align supply with demand obscures the extent of an electricity consumer’s dependence on fossil fuel–fired electricity generation. Until the grid is fully decarbonized, all electricity consumers who draw power from the grid will, to some extent, still depend on nonrenewable generation insofar as the reliability of the grid depends on overall supply meeting overall demand and some supply continues to come from fossil fuel generation. Moreover, because electricity is fungible on the grid, no consumer can know whether the power they are using originated from a renewable source. This level of dependence on nonrenewable sources is unavoidable, at least for consumers that pull power from the grid. But existing renewable energy markets add another layer of dependence.

Because renewable energy markets do not match generation and use temporally or geographically, at any particular moment, renewable energy consumers may be using more electricity than is available from renewable sources. Renewable energy users essentially run a debt of renewable energy when it is scarce, relying on periods in which it is plentiful to replenish their stock. But this is not how electricity works because electric power must constantly provide supply to meet demand, at least until storage capabilities are much more developed. To say that a consumer actually uses renewable energy would require the consumer to match their electricity usage with their renewable energy purchases so that RECs were generated at the same time and within the same regional market in which the electricity was used. In the meantime, however, misaligned renewable energy markets perpetuate dependence on fossil fuel generation by suppressing price signals that would encourage investment in renewable energy generation during periods and in markets in which it is scarce.

IV. 24/7 Clean Energy: Aligning Generation and Use

The renewable energy procurement strategy known as 24/7 clean energy aligns renewable generation and use on an hourly basis, addressing the generation-use mismatch in renewable energy markets.[194] For example, a consumer purchasing 24/7 clean energy would purchase RECs generated in the same hour and within the same regional electricity market as the user—as close to actual use of renewable energy as is possible given the reality that electrons cannot be traced in the grid. The following Table summarizes the differences between conventional renewable energy purchases and 24/7 clean energy:

| Constraint | Conventional REC Purchase | 24/7 Clean Energy Strategy |

| Time | Electricity usage may occur as much as 1–5 years after renewable energy generation. | Electricity usage occurs in the same hour as generation. |

| Location | Electricity usage may occur anywhere in the United States for voluntary purchases, although compliance purchases may be more constrained. | Electricity usage occurs in the same regional electricity market as generation. |

The premise of 24/7 clean energy is that we need to develop renewable energy generation that can meet the full electricity needs of the American economy, thereby minimizing support from fossil fuel generation.[195] Rather than focusing just on growing the overall size of renewable energy markets, alignment advances the prospects of a decarbonized future by matching renewable energy generation with electricity needs.

The remainder of this Part examines the concept of 24/7 clean energy in more detail. Section IV.A explains the 24/7 clean energy strategy and its potential benefits. Section IV.B identifies the ways in which 24/7 clean energy can support decarbonization. Section IV.C addresses some potential caveats and limitations to the arguments in Section IV.B. Finally, Section IV.D identifies several governmental and private sector initiatives that can support implementation of 24/7 clean energy strategies.

A. Concept

The concept of aligning renewable generation and use is not entirely new, and both compliance and voluntary renewable energy purchases have used crude forms of alignment for decades, requiring that RECs be used within a certain time frame of their creation.[196] When renewable energy was in its early stages of development, these rough alignment efforts may have been sufficient to leverage the impacts of renewable energy purchases. When there was almost no renewable energy on the grid, any renewable energy transaction was significant. And a REC purchaser does know with confidence that renewable electricity was generated at a certain place and time, as indicated by the amount the RECs represent and because no other consumer can claim use of the same renewable generation. This is not nothing.

As renewable energy has penetrated electricity markets, however, the shortcomings of conventional alignment have become more pronounced.[197] Without more precise alignment, significant amounts of fossil fuel–fired generation are being used to support renewable energy use, allowing electricity consumers to use electricity whenever they want, regardless of whether any renewable energy is being generated at that moment.[198] More precise alignment strategies are therefore crucial elements of efforts to achieve extensive penetration of renewable energy in electricity markets so that renewable energy use does not have to rely on fossil fuel–fired generation.[199] The concept of 24/7 clean energy arose to meet that need through closer alignment of renewable energy generation and use.[200]

Although currently more of a concept and a goal than an actuality, 24/7 clean energy is rapidly winning attention and support among thought leaders in decarbonization:

- The United Nations has issued a Call to Action that identifies five principles to guide 24/7 clean energy strategy,[201] and has spearheaded a 24/7 Carbon Free Energy Compact that sets forth steps necessary to implement a 24/7 clean energy strategy and invites stakeholders to join the effort.[202]

- The Biden Administration has signaled support for a 24/7 clean energy procurement strategy.[203] Some localities are doing the same.[204]

- Renewable energy tracking systems are developing methods for precisely matching the timing of renewable energy generation and electricity use, which will allow creation of a market for 24/7 clean energy.[205]

- Google, Microsoft, and Adobe have reoriented their clean energy purchasing strategies around the 24/7 concept. Google, for example, recently contracted with multinational power supplier AES Corporation to purchase clean energy as measured on an hourly basis, using power from a portfolio of wind, solar, hydropower, and battery storage resources.[206]

- Electricity providers are starting to develop new products and services to link supply and demand consistent with 24/7 clean energy’s alignment approach.[207]

What has been missing from these preliminary conversations is an explanation of the misalignment problem, how 24/7 clean energy corrects the misalignment problem, the advantages and limitations of 24/7 clean energy, and how policies and strategies can promote 24/7 clean energy. This Article fills that void.

B. Benefits

Creating a more time-sensitive and location-sensitive market for renewable energy can accelerate and smooth the transition to a decarbonized electricity sector. Renewable energy generated during times in which supply is plentiful—such as when the sun is shining or the wind is blowing—will remain inexpensive and perhaps become even cheaper as development costs continue to decline and as some renewable energy demand shifts to other generation.[208] But because a 24/7 strategy requires purchasing renewable energy that is available at the time of use, time-sensitive demand for renewable energy requires generation at times and locations that are more challenging and therefore costly. Solar and onshore wind power currently account for most renewable energy, but they are not always available. Other renewable technologies, such as geothermal and offshore wind, thus may be necessary to meet time-sensitive demand. Renewable energy procurement that uses a 24/7 strategy is willing to pay a premium for such renewable generation in a way that existing time-insensitive markets, which attach no value to the timing of renewable generation, are not. Price premiums for scarce renewable energy will properly compensate generation and storage resources that supply electricity during these times when renewable energy is less available, incentivizing further development of these resources. This will allow renewable energy to penetrate electricity markets further, facilitating decarbonization.

A 24/7 clean energy strategy will have other impacts that will support decarbonization beyond just incentivizing the construction of more renewable energy projects that will better meet the needs of electricity customers. Aligning renewable energy supply with use also will increase the incentives for transmission and storage that will make available additional supplies of renewable energy at the times and locations where it is needed, as well as shift demand from periods of relative scarcity to periods of abundance.

The role and significance of transmission in enabling renewable energy development is already well established, if still underappreciated.[209] One of the challenges of renewable energy development is that renewable energy generation is often located far from population centers where demand for electricity is concentrated.[210] This transmission congestion is currently slowing renewable energy development.[211] Transmission can carry renewably generated power to where electricity is needed.[212] Additional transmission capacity thus allows the grid more flexibility in matching electricity supply and demand.[213] Decarbonization will require dramatically more transmission,[214] and transmission can significantly reduce the cost of decarbonization.[215]

To illustrate the synergistic relationship between 24/7 clean energy and transmission, take a simplified example of two states, one that produces ample electricity from solar power during the day and one that produces plentiful electricity from wind power at night. With a conventional renewable energy market that does not align generation and use, the wind state can count its wind power generation toward electricity use both at night and during the day, even though the wind power is only generating electricity at night. And the solar state can count its solar power generation toward electricity use both at night and during the day, even though the solar power is only generating electricity during the day. With a 24/7 clean energy strategy, however, generation and use must align. Electricity consumers cannot use wind power generated at night to meet electricity use during the day and cannot use solar power generated during the day to meet electricity use at night. This creates a stronger incentive for the construction of transmission that can carry the solar state’s power to the wind state and the wind state’s power to the solar state. Enhanced transmission, in turn, enables renewable energy projects to reach more consumers with their power. Transmission also enables electricity grids to increase reliability at lower cost in the face of challenges from variable renewable energy production. Studies have predicted that significant economic benefits would result from interregional integration of the electricity grid through increased transmission.[216]

A 24/7 clean energy strategy can similarly synergize with electricity storage. Electricity storage accounts for a tiny share of electricity markets but is expanding rapidly.[217] Like additional transmission, storage can give much-needed flexibility to the grid. Whereas existing renewable energy markets simply ignore the mismatch between renewable energy generation and use, electricity storage can create an alignment where none was previously possible by storing renewably generated power when it is plentiful and then releasing it to the grid when it is scarce.[218] Because a 24/7 strategy increases demand for renewable energy during periods in which it is scarce, a 24/7 strategy increases the value of storage which can essentially transmit electricity over time. This will incentivize the development of additional storage, which in turn will reduce the scarcity of renewable power and support decarbonization.

Finally, in addition to affecting renewable energy supply, 24/7 clean energy encourages more effective demand strategies. Just as storage contributes to the alignment of generation and use by allowing renewable energy supply to shift to meet demand, demand strategies can contribute to alignment by shifting demand to meet supply.[219] And 24/7 clean energy strategies do this naturally by creating price signals that encourage such demand shifts. Consumers who are mandated or voluntarily choose to purchase 24/7 clean energy will face higher prices for RECs generated at times and locations at which renewable energy is scarce. For those consumers with time-flexible demand, these higher prices will incentivize them to shift demand from periods in which renewable energy is scarce and more expensive to periods in which it is plentiful and cheap. This shifting of demand provides another mechanism for aligning renewable energy supply with demand and can be accomplished in significant part simply through price signals without additional policy intervention.[220]

A recent study by Princeton researchers supports the decarbonization advantages of a 24/7 clean energy strategy over conventional renewable energy purchasing strategies.[221] That study, which modeled the effects of 24/7 clean energy procurement in California and the PJM Interconnection territory, concluded that hourly matching of clean energy use and generation can significantly reduce carbon emissions below emissions levels with only annual matching.[222] Two factors drive the emissions reductions. First, more precisely matching clean energy supply and demand increases the amount of fossil fuel–fired power that clean energy generation displaces.[223] Second, purchasing 24/7 clean energy increases the overall quantity of clean energy generation, while also displacing more fossil fuel–fired power.[224] In addition, a 24/7 clean energy strategy increases early deployment of advanced clean energy technologies such as advanced geothermal, nuclear, and long-duration storage, whereas conventional REC purchasing primarily increases solar and wind generation.[225] This last effect is especially important because advanced clean energy technologies can potentially provide more consistent power output than variable resources such as solar and wind.[226] Finally, a 24/7 clean energy strategy causes more retirement of natural gas power plants than conventional REC transactions cause.[227]

The results of the Princeton study are not definitive and should not be overstated. The study’s analysis relies on various assumptions that may or may not accurately reflect the realities of the grid and electricity markets. For example, the model used in the study did not account for the uncertainty of projecting hourly electricity demand or clean energy supply.[228] The analysis also assumed that all customers participating in the 24/7 clean energy strategy would manage their purchases in aggregate rather than individually.[229] More analysis is needed to better understand the range of possible consequences from 24/7 clean energy—and how to structure 24/7 policies and strategies to maximize the benefits while avoiding pitfalls. Nevertheless, the Princeton study provides significant support for the claim that adopting a 24/7 clean energy strategy can accelerate decarbonization.

C. Caveats

Although 24/7 clean energy can support the transition to a decarbonized electricity sector, it is not a panacea. Accordingly, some caveats and acknowledgements of limitations are in order.

First, a 24/7 clean energy strategy is not the only path to continued strong growth in renewable energy development. Renewable energy can continue to grow, both in absolute quantities and in its share of electricity generation, without the intentional alignment of generation and use that 24/7 clean energy entails. As renewable energy further penetrates the electricity sector, renewable energy generation increasingly will saturate the lowest-cost times and locations and push out into more times and locations. To some extent, then, the beneficial consequences of 24/7 clean energy—development of renewable energy to meet electricity needs—will occur over the long term even without a deliberate 24/7 strategy.[230] In the meantime, renewable energy will have had time to expand and develop—and likely continue to innovate in ways that reduce development costs—in the conditions in which renewable energy is cheapest and easiest to generate. This should maximize the total quantity of renewable energy generation in the near term. Moreover, while that low-cost development continues, electricity storage and transmission will have had time to expand, which will facilitate broader and deeper deployment of renewable energy. These factors could lead a rational decision-maker to adopt a “wait and see” approach to 24/7 clean energy, focusing instead for the near future on pushing for renewable energy development when and where it is cheapest and easiest.

A “wait and see” approach to 24/7 clean energy, however, postpones action when time is of the absolute essence.[231] Renewable energy policies and strategies need to maximize development in both easy and more difficult situations. If the electricity sector is going to transition to renewable energy, then it needs renewable energy supply whenever and wherever people use electricity, not just when and where it is cheapest to produce. The climate is changing too rapidly to wait. Moreover, the history of renewable energy development teaches us that forcing development early spurs innovation that can dramatically reduce costs later.[232] Thus, if forward-thinking policymakers and electricity consumers implement a 24/7 clean energy approach now, their action is likely to spur innovations that will facilitate broader 24/7 clean energy development in the future.[233] The choice, properly understood, is not whether to develop 24/7 clean energy now or later, but rather what we can do now to facilitate 24/7 clean energy as quickly as possible. Moving forward aggressively now would seem to create the greatest likelihood of swift development of renewable energy generation that can meet our electricity needs around the clock and around the country.

Second, renewable energy strategies other than 24/7 clean energy also can support decarbonization. The success of a renewable energy policy or strategy can be evaluated by its impact on renewable energy markets. And impact in renewable energy markets can be measured a variety of ways, each of which may point in the direction of its own strategy. A 24/7 clean energy strategy frames impact in terms of aligning renewable energy generation and use, but other possible frameworks exist. For example, impact can be measured in terms of the effect of a renewable energy purchase on carbon emissions,[234] which lends itself to a strategy that attempts to maximize the emissions displaced by a renewable energy purchase.[235] Or impact can be measured in terms of how much a renewable energy purchase increases overall renewable energy generation, suggesting a strategy that focuses on renewable energy purchases that lead to additional renewable energy projects—known as additionality.[236] Each of these strategies has its strengths and its shortcomings, especially when applied in practice. In particular, both emissions-based and additionality-based strategies, when rigorously applied, would require electricity consumers to trace the consequences of their purchases through electricity markets to determine their impacts on project development, a very difficult task.[237]

As far as immediate impacts go, it is difficult to argue against emissions reductions or additionality. But aligning renewable energy generation and use with 24/7 clean energy strategies creates the conditions necessary for long-term decarbonization of the electricity sector. It therefore should play an important role in renewable energy policy and strategy, albeit not to the exclusion of other strategies.