Open PDF in Browser: Vittoria Battocletti,* Luca Enriques† & Alessandro Romano,‡ The Voluntary Carbon Market: Market Failures and Policy Implications

Many companies have made environmental pledges and launched products that claim to be carbon neutral. In most of these instances, corporations rely on carbon offsets. In this Article, we investigate the functioning of the market on which these offsets are created and exchanged, namely the voluntary carbon market, and look into the question of whether and, if so, how it should be subject to regulation. We start by shedding light on the mechanics of this market and then explain why a well-functioning voluntary carbon market is necessary to fight global warming and can also help developing countries build less carbon-intensive economies. However, we also spotlight the conflicts of interest and imperfect information problems that plague the voluntary carbon market and prevent it from achieving its full potential. Further, we explain why the proposals advanced by some members of Congress to regulate this market are misguided. Finally, we offer a proposal that can contribute to improving the functioning of the voluntary carbon market, thus increasing the likelihood that firms will rely on high-quality offsets to reach their climate goals.

Introduction

Imagine that you are purchasing a flight ticket for what promises to be the trip of a lifetime. Despite the excitement, one thing bothers you: you know that flying causes significant emissions.[1] Then a prompt pops up on your screen that appears to resolve your concerns. For only a few dollars, you can offset your emissions and enjoy a guilt-free trip. But can you trust this offer? Can you be sure that by paying just a few dollars, your emissions will actually be offset? In this Article, we delve into the intricacies of the voluntary carbon market (“VCM”) and show that often the answer is “no.” The core issue we identify is that none of the relevant players in this market have sufficient incentives to ensure the quality of the products traded therein.

The VCM is a largely unregulated market[2] where private actors buy carbon offsets[3] to voluntarily mitigate the effects of their choices on the climate.[4] For instance, firms might buy carbon offsets to claim that their products are carbon neutral.[5] Pushed by firms’ desire to become—or at least appear to become—sustainable and green, the VCM is growing exponentially. For instance, McKinsey forecasts that it might grow by a factor of as much as one hundred by 2050.[6]

The process of creating a carbon offset starts with an entity that develops emission reduction projects, also known as the project developer. The project developer might endeavor, say, to plant one million trees, which will absorb a certain amount of carbon dioxide (CO2). For the sake of simplicity, we will assume that those trees will remove one hundred tons of CO2 from the atmosphere each year. At this point, the project developer will generally have the emission removal certified by one of the main standard setters, such as Verra or Gold Standard.[7] In turn, standard setters rely on validation and verification bodies (“VVBs”) to audit the given project and ensure that it meets the quality requirements that they impose. Therefore, a key characteristic of the VCM is that there are two actors—standard setters and VVBs—assessing the quality of carbon offsets. In our example, a VVB would check that the trees have really been planted and provide assurances that they can absorb at least one hundred tons of CO2 each year, while the standard setter would certify that the VVB carried out its audit according to the former’s standards and verified the existence of the trees. At the end of this process, one carbon offset is issued for each metric ton of CO2 removed from the atmosphere. Thus, in our example, the standard setter should certify one hundred carbon offsets each year. The project developer would then be able to sell these one hundred offsets. A corporation that emits one hundred tons of CO2 to make a product could claim that the product is carbon neutral if it buys all the offsets generated by this project.

The problem lies in the fact that each of the players in this game—the project developer, the standard setter, and the VVB—has incentives to overstate offset claims (hereinafter, “to inflate offsets”). Project developers can obviously make more money if they have more than one hundred offsets to sell. Similarly, according to current practice,[8] standard setters’ fees depend on how many offsets they certify; hence, the greater the number of offsets they certify, the higher their revenues and profit. Furthermore, it is project developers who hire and pay VVBs, while it is standard setters who decide which VVBs to accredit and hence which VVBs can be hired by project developers.[9] As a consequence, VVBs have incentives to cater to the preferences of both project developers and standard setters and thus to inflate offsets.

Admittedly, if offset buyers were interested in purchasing only offsets that correspond to true reductions of CO2 in the atmosphere and could easily spot offset inflation, then inflating offsets would not be a sustainable strategy. Put differently, if, as a prospective buyer, you could tell with certainty that the carbon offset advertised on the online travel agency webpage does not correspond to a true reduction in emissions, you would have limited incentives to purchase it. But because assessing the quality of offsets is extremely complicated, you can have no such certainty. Furthermore, offset buyers might prefer cheap and inflated offsets for several reasons. First, corporate buyers are obviously happy to purchase more offsets per dollar paid so that they can make their products carbon neutral at a lower cost. Second, carbon offsets certified by the leading standard setters increasingly provide regulatory benefits.[10] For instance, in some countries, corporations purchasing carbon offsets certified by the leading standard setters can pay lower taxes.[11] It is clear that these companies have incentives to purchase as many offsets for as low a cost as possible to cut their tax bill. Thus, even buyers might prefer inflated offsets. Third, retail buyers who purchase cheap and inflated carbon offsets—or carbon neutral products relying on such offsets—might experience a warm glow, so long as they do not discover with certainty that offsets are inflated.[12]

As all market players prefer inflated offsets, it is unsurprising that there is ample empirical evidence of offset inflation,[13] and hence that you cannot trust the prompt that pops up on your computer screen.

Against this background, this Article makes several contributions. First, it provides the first in-depth analysis of how VCMs function, the economic incentives of their main actors, and the market failures by which it is plagued. Second, it provides an economic justification for the emergence of a market structure in which two actors—standard setters and VVBs—assess the quality of offsets, acting jointly as gatekeepers. Third, it explains why the proposals advanced by some members of Congress to regulate this market are unlikely to mitigate offset inflation. Fourth, it offers a simple policy recipe to bolster the reputational sanctions associated with offset inflation and therefore to improve the functioning of the VCM.

The Article proceeds as follows: Part I uses a real-world example to explain why a well-functioning voluntary market for carbon offsets is important. Part II describes what carbon offsets are, how they are developed, and which quality requirements they must meet. Part III describes the evolution of the VCM and the main features of the most important market players. It also outlines the current regulations affecting the VCM. Part IV offers an in-depth analysis of the market failures that plague the VCM. Part V discusses what policymakers should and should not do to improve—or at least not worsen—the functioning of the VCM. Part VI briefly concludes.

I. Why the Voluntary Carbon Market Can Play a Role in Mitigating Climate Change

In this Part, we use the real-world example of the Katingan Mentaya Project to give a sense of the many potential benefits associated with a well-functioning voluntary carbon market. The Katingan Mentaya Project advertises itself as “living proof that carbon finance can combat climate change,”[14] boasting the generation of 7.5 million carbon offsets per year.[15] The basic idea behind the project is as simple as it is appealing. It aims to protect more than 150,000 hectares of tropical forest peatland, preventing its conversion into industrial acacia plantations for paper production.[16] Absent the project, the forest would have been cleared and the peat drained, which would have resulted in vast stocks of carbon being released into the atmosphere.[17] Accordingly, the project contributes to the mitigation of climate change by avoiding emissions equivalent to the removal of two million cars from the road each year.[18] In fact, its developers argue that the project does much more than that. Among other things, they claim that it contributes to gender equality and protects a variety of species, including five that are critically endangered.[19]

What is more, the Katingan Mentaya Project achieves these benefits while also being a gold mine for the project developers. A reasonable estimate is that the carbon offsets generated by the project can be sold for five dollars,[20] which would translate into annual revenues of $37.5 million. The project developer has, in fact, succeeded in selling these offsets to large emitters such as Shell and Volkswagen.[21]

If one could take carbon offset claims at face value, it would be clear why a thriving voluntary market for carbon offsets may play a key role in the fight against climate change. First, Article 2 of the Paris Agreement sets the goal of “[h]olding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels, recognizing that this would significantly reduce the risks and impacts of climate change.”[22] However, limiting a temperature increase to 1.5 degrees Celsius would require a total future carbon budget from 2020 onwards of 400 to 500 GtCO2.[23] This would require a significant decrease in emissions, which currently stand at approximately 40 GtCO2 per year.[24] Given the shrinking carbon budget, the Intergovernmental Panel on Climate Change has acknowledged that projects aimed at removing carbon dioxide from the atmosphere are necessary.[25] But these projects are costly, and thus far it has proven difficult to attract sufficient capital. The VCM can help unlock the funds necessary to develop these projects and thus reach the goals of the Paris Agreement.

Second, as in the case of the Katingan Mentaya Project, the money often comes from large emitters and almost invariably from countries that, historically, have been responsible for the bulk of greenhouse gas (GHG) emissions, while the projects are often located in developing countries.[26] Thus, a strong ethical argument in support of the VCM is that it shifts the cost of protecting environmental resources onto the countries and companies that are largely responsible for global warming.[27]

Third, these projects can channel funds and technologies to help developing countries build economies that are less carbon intensive[28] while fostering a wide array of additional benefits like promoting gender equality. For instance, the developers of the Katingan Mentaya Project declare that they have been training and hiring women to work in fields that are traditionally dominated by men.[29] Once again, these activities are ultimately funded by the corporations that buy offsets instead of weighing on local taxpayers and local communities.

Unfortunately, all that glitters is not gold: as we discuss in Part IV, the VCM is currently plagued by market failures that may well jeopardize its ability to contribute to climate change mitigation. The Katingan Mentaya Project itself has been accused of grossly overstating the emissions it can offset.[30] Some have even claimed that there was never a plan to replace the peatland with plantations for paper production and that therefore the entire project is just a smokescreen.[31] In addition, there are doubts as to whether these projects really benefit local populations. For instance, the Kichwa community was allegedly forced out of its land in Cordillera Azul National Park by an offset project from an “unnamed extractive firm” without receiving any compensation.[32] As a result of such practices, several Indigenous communities have reported that they are studying carbon market regulations to avoid becoming the prey of “carbon pirates.”[33]

Serious as the concerns about the failures in the VCM may be, the significant benefits that this market has the potential to generate fully warrant a spotlight on its shortcomings and reflection upon how they should (and should not) be addressed.

II. Carbon Offsets: What They Are and How They Come to Be

A carbon offset is “a reduction in GHG emissions – or an increase in carbon storage (e.g., through land restoration or the planting of trees) – that is used to compensate for emissions that occur elsewhere.”[34] Generally, one carbon offset refers to one ton of reduced CO2 or its GHG equivalent.

Buyers of carbon offsets finance a certified climate action project, aimed at reducing or capturing emissions. As further discussed in Section III.B.2, this tool has become very appealing for companies searching for ways to compensate for their emissions and reach their carbon neutrality goals. In this Part, we discuss the different kinds of carbon offsets, the offset production process, and the requirements that an offset should meet to be considered high-quality.

A. Types of Carbon Offsets

Carbon offset projects can be divided into two categories: avoidance (or reduction) projects and removal (or sequestration) projects.

Avoidance projects eliminate or lower emissions from sources and operations. These offsets can either be nature-based or technology-based.[35] An example of nature-based avoidance is the Katingan Mentaya Project discussed in Part I, whereas an example of technology-based emission avoidance entails switching to renewable energy sources.[36] But technology-based projects come in all shapes and forms. For instance, a recent offset project by Justa StoveWorks involves the distribution of energy-efficient and smoke-reducing cookstoves in Central America at a heavily subsidized rate.[37] Besides helping local communities, these stoves produce significantly lower emissions than the appliances that would otherwise be used.[38]

Removal projects aim to directly remove CO2 from the atmosphere.[39] These projects can again be either nature- or technology-based.[40] Examples of the former are reforestation or afforestation projects, whereas the latter involve the use of technologies aimed to capture and store CO2.[41] For instance, CarbonCapture Inc., a U.S.-based climate tech company, recently announced the largest removal project in United States, claiming that its new facility in Wyoming will be able to remove five million tons of atmospheric CO2 annually by 2030.[42]

While helpful to illustrate what lies beneath carbon offsets, this basic classification between avoidance and removal projects obscures the incredible variety of project types. The Ecosystem Marketplace, a nongovernmental organization (NGO), identifies 170 different types of offsets grouped into the following eight categories: renewable energy, household and community, chemical and industrial, energy efficiency, waste disposal, agriculture, transport, and forestry and land use.[43]

B. Developing a Carbon Offset Project

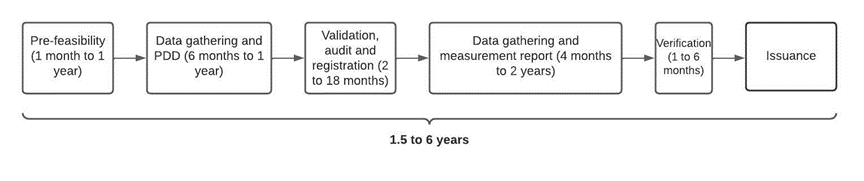

The process of developing a carbon offset project (Figure 1) typically takes between eighteen months and six years and has five phases. The development process starts with a project developer carrying out a pre-feasibility assessment,[44] initiating conversations with the relevant stakeholders, and selecting a standard setter to later certify the project.

Figure 1: The Development Process of Carbon Offsets[45]

During the second step, the project developer creates a project-design document.[46] This document lays out the main characteristics of the project, providing the information needed to assess its quality and the projected amount of emissions avoided or reduced over the years.[47]

In the next phase, the project developer hires a VVB to validate the project-design document.[48] The VVB must be chosen among those accredited by the standard setter certifying the project. To be accredited, VVBs must pay the standard setter both an accreditation fee and an annual fee.

As the project unfolds, the VVB monitors whether everything is proceeding according to plan. Monitoring generally includes audits, in-person site visits, and a detailed analysis of the relevant data.[49] Eventually, the VVB issues a final report describing its findings and attesting whether the project meets the necessary quality standards.

At this point, the standard setter verifies that the project has been executed in line with its standards and determines the volume of the offsets generated. Once the offsets are certified, an issuance fee is paid by the project developer to the standard setter and offsets can finally be issued. Generally, the fee paid by the project developer to the standard setter increases with the number of offsets certified.[50] Offset buyers who want to purchase the certified offsets must also pay an account-registration fee to the standard setter. Figure 2 summarizes the relationships among the main players involved in this process.

Figure 2: The VCM: Players and Cash Flows

C. Carbon Offsets: Quality Requirements

Not all offsets are created equal; hence, it is important to ensure that only high-quality offsets are certified and traded on the VCM. But what is a high-quality offset?

The Taskforce on Scaling Voluntary Carbon Markets, a self-defined “private sector-led initiative working to scale an effective and efficient voluntary carbon market to help meet the goals of the Paris Agreement,”[51] tried to answer this question. According to the Taskforce, offsets should be real, additional, based on a credible and realistic baseline, monitored, reported, verified, and permanent. Furthermore, they should minimize leakage and avoid doing net harm.[52]

The key feature is additionality, which requires that the reduction of CO2 in the atmosphere would not have occurred without the project. Additionality has two components: financial additionality and regulatory additionality. The former requires that the project would not have been implemented without the revenues generated from the sale of offsets. Proving financial additionality is particularly challenging for avoidance projects as it requires establishing beyond doubt that no emissions would have been avoided without the project.[53] In other words, it relies on a counterfactual claim.[54] On the contrary, financial additionality is easier to establish for removal projects and especially for technology-based ones. In fact, the use of technology to remove CO2 from the atmosphere is expensive, and it is thus unlikely that the project developer would have sufficient incentives to engage in such a project without the possibility of selling the corresponding offsets.[55]

Regulatory additionality instead requires that the project is not carried out to meet a regulatory requirement.[56] Therefore, if an entity switches to renewable energy in response to new regulation, it cannot issue carbon offsets that fulfill the requirement.

Additionality must be calculated on the basis of a credible and realistic baseline. That is, independent third parties must offer estimates of the emissions in the absence of the activity.[57] For instance, formulating a baseline for a project aimed at preserving a forest implies estimating how many of the trees protected by the project would have been cut had it not been for the project. Estimating a baseline presents a challenge due to the inherent uncertainty associated with dealing with counterfactuals.[58] Because the way of assessing the baseline varies across projects, hundreds of different methodologies are currently in use.[59]

A further requirement is that offset projects be monitored, reported, and verified. As we discuss extensively in Section III.B.4, this feature implies that an accredited and independent VVB must carry out the necessary controls to ensure that the project unfolds as expected.[60]

In addition, carbon offsets should be permanent. Permanence implies that project developers should implement mechanisms to neutralize the effects of reversal events.[61] Permanence is hard to ensure for many kinds of offset projects and certainly for afforestation and reforestation ones, which are the most common. For example, Badgley et al. estimated that devastating wildfires in California caused the loss of between 4.6 million and 5.7 million offsets in the 2020 to 2021 period.[62] But it is not only wildfires that endanger the durability of carbon stored in forests: invasive insects, fungal pathogens, and droughts are also considerable threats.[63] Not surprisingly then, the efficacy of planting forests and trees to mitigate climate change has long been questioned.[64]

Carbon offsets should also minimize leakage, which refers to the idea that emissions avoided at one source might shift to a different location or sector.[65] For example, consider a case in which several timber forest owners start preserving their forests instead of harvesting them. The resulting drop in the quantity of timber supplied worldwide would inevitably cause a price increase. And that price increase would likely lead forest owners in other areas to expand their timber production and profit from the higher prices. In other words, the reduction in timber produced in one area would be offset by an increase in another area.[66] A corollary to this is that leakage should be assessed at an international level, as these kinds of dynamics can cross national boundaries.[67]

Finally, carbon offset projects should do no net harm, meaning that they should not damage local communities and ecosystems. A claim of no net harm is usually based on a careful impact assessment of the project and the creation of channels that allow all stakeholders to share their concerns and grievances.[68]

III. The Voluntary Carbon Market: Evolution and Structure

In this Part, we discuss the evolution of the VCM and identify its main market players. We also outline how the market has so far been subject to little regulation, with some state-level and sectoral exceptions.

A. Evolution of the Voluntary Carbon Market and the Influence of Compliance Markets

The seed of the VCM was planted in the 1980s, when an American electricity company brokered the first-known carbon offset deal with an NGO in Guatemala.[69] In the 1990s, the first private registry for voluntary offsets in the United States was established.[70] However, for many years the importance of the VCM remained limited. Only in 2016 did the VCM gain traction, growing by a factor of ten in only five years to reach $2 billion in 2021.[71]

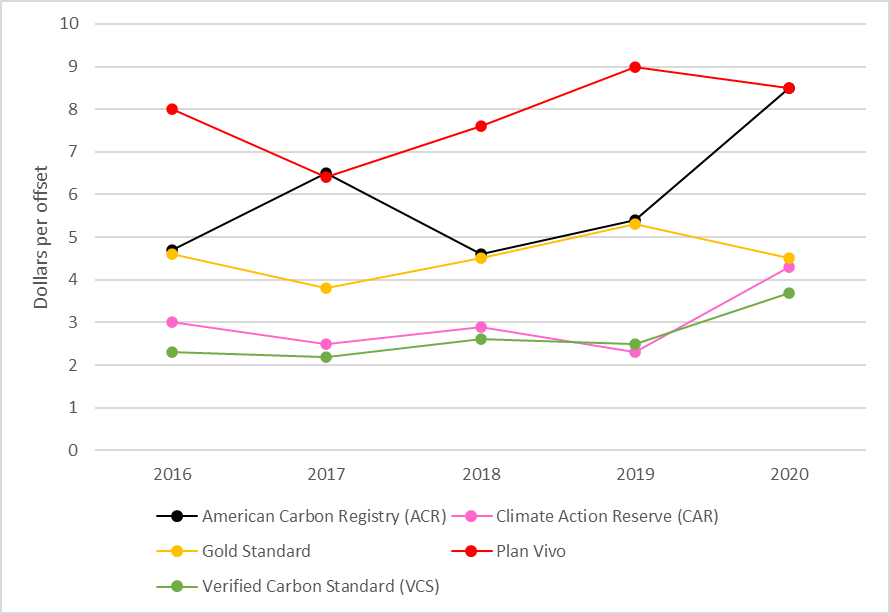

As the size of the market increased, the prices of offsets started to grow too, as shown in Figure 3.[72] Nevertheless, carbon offset prices arguably remain too low, possibly reflecting an adverse selection-equilibrium outcome which prevents high-quality projects from being developed.[73]

Figure 3: Price (dollar per ton) Trends of Carbon Offsets Certified by the Main Standard Setters

Figure 3: Price (dollar per ton) Trends of Carbon Offsets Certified by the Main Standard Setters

The evolution of the VCM is tightly intertwined with the development of the much larger compliance market for offsets. Compliance markets are schemes that exist under mandatory regulations aimed at curbing GHG emissions.[74] In such markets, players purchase carbon offsets to meet regulatory goals. The origins of compliance markets can be traced back to the Kyoto Protocol, whereby thirty-seven countries committed to emission reductions.[75] According to Article 12 of the Kyoto Protocol, the Clean Development Mechanism allows these countries to meet their commitments also by purchasing offsets (called “Certified Emission Reductions”) from emission reduction projects.[76]

The Clean Development Mechanism has had a profound influence on the VCM. For instance, the main standard setter in the VCM considers all the methodologies approved under the Clean Development Mechanism eligible for its offsets[77] and recognizes the VVBs approved under the Clean Development Mechanism.[78]

The Paris Agreement builds and expands on the Kyoto Protocol, with potentially huge effects on the VCM. A distinguishing feature of the Paris Agreement is that, unlike under the Kyoto Protocol, all countries are required to establish their own climate change targets, known as nationally determined contributions.[79] In order to reach their nationally determined contributions, countries can participate in international cooperation that results in internationally transferred mitigation outcomes.[80] In particular, Article 6(2) permits countries to trade emission reductions and removals to reach their nationally determined contributions.[81] To put it differently, countries are allowed to trade offsets to reach their climate targets. We will return to this point and the effect that this mechanism could have on the VCM in Section III.C.

B. Market Players

The VCM is comprised of four main actors: project developers, credit buyers, standard setters, and VVBs. This Section briefly describes each actor and highlights the complementary role played by standard setters and VVBs.

1. Project Developers

Project developers design a carbon offset project and then sell the related carbon offsets. Notably, the top twenty developers are responsible for almost 40 percent of total volumes, while the five largest are responsible for almost 20 percent.[82] However, most project developers only have experience with one project.[83]

Because the offset-development process can last up to six years, one of the challenges that project developers face is securing sufficient funding.[84] Project developers with sufficiently deep pockets can rely on their own funding, but other players must find offset buyers willing to directly finance the project even if they do not receive the carbon credits until later. For instance, in 2021 Royal Dutch Shell announced a $1.6 billion partnership with one of the world’s major project developers to develop 115 million carbon credits in five years.[85]

2. Credit Buyers

The demand side of the VCM is composed of two types of buyers: individuals intending to offset their carbon footprint and organizations willing to offset their emissions.[86]

Individuals can purchase carbon offsets directly via specialized websites, such as carbonfund.org[87] or Gold Standard’s website.[88] Alternatively, individuals can purchase offsets when buying products from many corporations, including airlines such as Cathay Airways,[89] Lufthansa,[90] and Jet Blue.[91]

However, most of the demand comes from corporations aiming to achieve their climate targets. For instance, Apple relied on carbon offsets to achieve carbon neutrality for the Apple Watch Series 9.[92] Similarly, Nespresso purchased carbon offsets to ensure that its coffee pods are carbon neutral.[93] The long list of companies that have been purchasing offsets includes Chevron, Comcast, Shell, Hyundai, and Volkswagen.[94]

3. Standard Setters

To certify the quality of carbon credits and reduce information asymmetries between project developers and offset buyers, the market relies on two kinds of information intermediaries: standard setters and VVBs. Standard setters set the quality requirements that a project needs to meet to be certified.[95] Standard setters, which are usually NGOs, are said to “act as the regulators of the VCM,”[96] and their certifications are widely regarded as the most important factor in choosing carbon offsets.[97] VVBs can thus be considered the primary gatekeepers of the VCM. In general, gatekeepers are information intermediaries that provide verification and certification services by pledging their professional reputations,[98] thus acting as “reputational intermediaries.”[99] Gatekeepers’ certifications help mitigate information asymmetries, allowing players with limited access to information to participate in the market simply by relying on the gatekeepers’ reputation.[100] Examples of gatekeepers include auditors, credit-rating agencies, and investment banks.[101] Given the role gatekeepers play, markets for gatekeepers’ services tend to be concentrated. This is because the larger a gatekeeper’s clientele, the weaker their incentives to cater to the preferences of any of their clients (e.g., one of the many bond issuers in the case of a rating agency).[102] For instance, if an auditor’s entire profit hinged on a single client engaged in shady practices, the auditor may hesitate to report them. Instead, when a gatekeeper interacts with many clients, the short-term gains it would obtain by catering to the preferences of one client would be outweighed by the long-term costs associated with losing their reputation as a reliable gatekeeper. To put it differently, the portfolio of customers of a gatekeeper needs to reach a critical mass before the market will consider that gatekeeper credible.

While there are other relevant players in the market, Verra and Gold Standard dominate it.[103] In 2019/20 Verra alone accounted for two-thirds of the market, while Gold Standard covered an additional 10 percent.[104]

Such a high level of market concentration means that the leading gatekeepers have an interest in preserving their reputation.[105] However, it also implies that standard setters have significant market power vis-à-vis both project developers and VVBs.

Most of standard setters’ revenues come from the fees they charge to project developers when certifying a project. For instance, Verra charges a variety of fees within its Verified Carbon Standard program, some of which are fixed while others depend on the quantity of offsets certified. One such fee is an issuance levy for each individual project and correlates with the quantity of offsets certified per year.[106] Table 1 reports the fee levels for different amounts of verified offsets issued for a given project.

| Table 1: Verra Issuance Levy Schedule[107] | |

| Number of verified offsets issued for a given project | Cost per offset ($) |

| 1-10,000 | 0.05 |

| 10,001-1,000,000 | 0.14 |

| 1,000,001-2,000,000 | 0.12 |

| 2,000,001-4,000,000 | 0.105 |

| 4,000,001-6,000,000 | 0.085 |

| 6,000,001-8,000,000 | 0.06 |

| 8,000,001-10,000,000 | 0.04 |

| >10,000,000 | 0.025 |

Given how their fees are structured, standard setters stand to increase their revenues—and presumably their profits—if they certify more offsets per project, which is unusual for services of this kind. For example, if Verra certified one million offsets for a given project, then the issuance levy would be $139,100, whereas if it certifies two million offsets it will be $259,100. By contrast, a credit rating agency—which, like a standard setter, is paid by the bond issuer requesting its services—charges a fee that is independent of the rating (say, AAA or BBB) it issues.

Standard setters also receive compensation from buyers, who pay a fee to be able to transfer and retire carbon credits, and from VVBs, which must pay an accreditation fee. For example, Verra charges an annual fee of $2,500 to each VVB.[108]

Finally, standard setters play a key role in ensuring an orderly market for offsets by keeping registries to prevent the double counting of credits. Registries assign credits a serial number, which, together with additional information, is made publicly available. Further, registries track the purchased and retired carbon offsets.[109]

4. Validation and Verification Bodies

In order to certify a project, standard setters rely on the validation and verification services provided by an external independent auditor, the VVB. This entity is usually a company, appointed by the project developer and accredited by the standard setter. Its job is twofold. First, the VVB should “validate” ex ante the project-design document according to the requirements outlined by the standard setter. Second, it should “verify” ex post that the project is generating the promised benefits.[110]

As noted above,[111] gatekeepers provide certifications to facilitate participation in a given market. In this case, the stamp of approval of the VVB is de facto necessary for project developers to access the VCM, given that standard setters require third-party validation and verification of the offsets. However, the identity of the VVB engaged in validating and verifying a project is generally displayed much less prominently than that of the standard setter that certified it. For this reason, VVBs are likely to be less recognizable by final buyers and hence have less reputational capital at stake than standard setters.[112] Another factor to consider is that the number of VVBs is fairly high, as Verra alone has thirty accredited VVBs that are currently active and thirty-one that are no longer active.[113] These numbers suggest both that the market is fragmented and that turnover among market players is significant, in stark contrast with the natural tendency of gatekeepers’ markets to be dominated by a few established players.

Moreover, the major standard setters have acknowledged that there is an undersupply of VVB services, which can result in both delays and lower-quality output. The bottleneck created by the limited supply of validation and verification services should not be underestimated: according to recent estimates, verification-related delays might impose costs of up to $2.6 billion to project developers and could prevent 4.8 GtCO2 credits from being issued between now and 2030.[114] This implies that standard setters might not have the luxury of being selective when accrediting VVBs.

In the presence of this combination of factors, one might be tempted to conclude that reputational constraints could fail to operate effectively on VVBs. However, VVBs’ access to the market is conditional upon their persuading another gatekeeper (the standard setter) that they deserve to be trusted. Clearly, standard setters are well-positioned to assess the quality of the work performed by a VVB. Therefore, at least in principle, they could immediately punish VVBs that fail to carry out high-quality verification and validation. In this vein, the scarcity of VVBs could also be seen as a signal of stringent standards applied by standard setters in certifying VVBs.

The verification and monitoring of projects carried out by VVBs are extremely costly. Therefore, this activity significantly affects the margins available to project developers.[115] This suggests caution before imposing rules that might further increase the costs of validation and verification, or that might make it more costly for VVBs to earn an accreditation from a leading standard setter.

5. A Double-Gatekeeper Market

A key feature of the VCM is the presence of two gatekeepers operating in the same market with the same stated goal, namely ensuring the quality of offset projects. This raises an obvious question: why are there two gatekeepers instead of just one?

While it is common to consider potential conflicts of interest a sufficient explanation for the separation of standard setting and certification,[116] we think the answer rather lies in the heterogeneity of offset projects and in the crucial role played by reputation in gatekeeper-services markets. As previously discussed, gatekeepers must be repeat players, and hence have a sufficiently large portfolio of customers, to be credible. Given the diversity of projects—in terms of both type and geographical location—an entity responsible for validating and monitoring offset projects would require an enormous array of competencies to build such a portfolio of customers. The market has thus produced two gatekeepers that play complementary roles. On the one hand, VVBs provide the technical knowledge required to assess projects. However, because quickly developing this kind of knowledge in-house for a sufficiently wide variety of projects is very challenging, no single VVB could reach the size needed to persuade the market that it would not trade long-term reputation for short-term gains. Standard setters need less specialized knowledge because they do not carry out the same in-depth analysis of each project. This allows standard setters to play a monitoring role for a much wider range of projects and hence to act as reputational guarantors of the work carried out by VVBs.

This analysis has two important implications: first, interventions aimed at enhancing the reputational sanctions faced by VVBs are likely to be ineffective because VVBs are bound to have limited reputational capital among end-buyers; second, it is crucial to ensure that standard setters face sufficient reputational sanctions for inflated offsets so that they have incentives to discipline the behavior of VVBs. However, as we discuss in Part IV, the market failures that plague the VCM might prevent that from happening.

C. Regulations Related with the Voluntary Carbon Market

The VCM is largely unregulated, with private actors having developed all the standards and rules by which market actors play.[117] However, some regulations may be extended to carbon offsets, others have been recently proposed, while international organizations and individual jurisdictions outside the United States have adopted climate change mitigation rules explicitly relying on the VCM.

To begin with, the Commodity Futures Trading Commission (“CFTC”) might have the authority to prosecute fraud and manipulation in the VCM. In fact, carbon offsets fall under the definition of “commodity” for the purposes of the Commodity Exchange Act.[118] Moreover, specific rules might apply depending on how the contract is designed. For instance, several carbon offset derivatives contracts are already listed on the CFTC’s regulated exchanges,[119] and for these contracts the standard rules for derivatives apply. However, none of these rules engage with the thorny question of what constitutes a high-quality offset.

Section 45(a) of the Federal Trade Commission Act, which deals with unfair or deceptive acts or practices affecting commerce, may help answer this question.[120] Statements on offsets are deceptive when they misrepresent regulatory additionality (i.e., in cases where the activity resulting in a reduction of emissions was required by law), or when they misrepresent the moment at which the CO2 emissions will be offset (i.e., claiming that emissions will be offset now when they are actually going to be offset years down the road).[121] In these two cases, we can reasonably expect policymakers to be able to identify misconduct. However, Section 45(a) does not seem to cover cases where the issue at stake is the quality of the offsets used in an advertisement and where the deception is not as blatant as in these two examples.

Some policymakers believe that this framework is insufficient. For example, in 2022 a group of Democratic senators urged the CFTC to “develop qualifying standards for carbon offsets that effectively reduce greenhouse gas emissions.”[122] A similar request was advanced by a group of House Democrats to the U.S. Comptroller General.[123] However, at the time of writing, these proposals had not yet resulted in concrete action.

At the state level, California has recently passed Assembly Bill 1305. While the bill targets the VCM, it only imposes disclosure obligations on entities that sell carbon offsets and on entities relying on carbon offsets to substantiate their environmental claims,[124] while it does not introduce rules to identify and sanction offset inflation.

Meanwhile, international sectoral agreements as well as regulations in individual jurisdictions have been implemented that rely on the VCM to reduce net emissions. The International Civil Aviation Organization has adopted a global market-based mechanism, the Carbon Offsetting and Reduction Scheme for International Aviation (“CORSIA”).[125] This mechanism aims to offset the CO2 emissions caused by airlines. By 2027, almost 90 percent of all international aviation activities will be subject to mandatory offsetting requirements.[126] This scheme requires airlines to buy carbon credits to offset the emissions generated through their activity. Importantly, to be eligible, offsets must be certified by an approved carbon offsetting program.[127] Among the standard setters approved by CORSIA are Verra and Gold Standard, which therefore have the power to certify offsets that can be used to comply with the CORSIA scheme.[128] The importance of this regulatory power cannot be overstated given that the aviation industry alone is responsible for roughly 2.5 percent of total CO2 emissions.[129]

Other countries have incorporated carbon offsets in their carbon tax legislation. The South African government has imposed a tax of about 120 South African Rands (approximately seven U.S. dollars at the time of writing) on each ton of carbon emissions.[130] Taxed entities can offset part of their emissions using carbon offsets,[131] and offsets approved by Verra can be used to this end.[132] In Colombia, Verra’s certifications can be used to offset up to half of their tax liability associated with the country’s carbon tax.[133] That is, an entity might potentially pay only half of it, provided that it purchases enough carbon offsets certified by Verra. Other countries, such as Chile and Singapore, appear to be following the example set by South Africa and Colombia.[134]

The framework introduced by Article 6 of the Paris Agreement could also play a key role. The precise mechanics of that framework are still undefined, and countries appear to have significant freedom in determining the criteria for offsets eligibility under this framework. Yet, it is reasonable to expect that standard setters like Golden Standard and Verra will play a role.[135]

Overall, the VCM remains a highly unregulated market, with some jurisdictions moving in the direction of issuing climate mitigation regimes that acknowledge the contribution of carbon offsets certified by the leading market players, an aspect we come back to in Section IV.C.

IV. Market Failures

To the best of our knowledge, there have been no comprehensive studies of the overall quality of carbon offset projects. However, there is some evidence that the VCM has not always delivered on its promises. Compensate, a foundation that focuses on improving the integrity of the VCM, analyzed over one hundred nature-based projects certified by leading standard setters and concluded that 52 percent of the projects failed basic additionality tests.[136] In fact, the projects were either protecting forests that were never actually in danger[137] or referred to afforestation projects that were already planned for commercial purposes.[138] Similarly, a report prepared by the Guardian, the German weekly Die Zeit, and SourceMaterial (a non-profit investigative journalism organization) found that more than 90 percent of Verra’s rainforest offset credits are likely “phantom credits” rather than genuine carbon reductions.[139] Moreover, peer-reviewed studies have also cast doubt on the quality of carbon offsets. For example, West et al. found that Verra-certified projects aiming to reduce emissions from deforestation and forest degradation in the Amazon rainforest overstated emissions reductions.[140] One common concern is the definition of the baseline, as the projects’ estimates had been grounded in historical deforestation trends that were no longer plausible at the time of the project’s development.[141] Verra has strongly disputed the Guardian’s report and the conclusions reached by West and coauthors.[142]

Controversies have also involved some of the world’s largest corporations. For instance, in collaboration with Nature Conservancy, a non-profit organization, corporate giants like BlackRock, JPMorgan Chase, and Disney are investing millions to preserve forests in the United States Northeast, or so they claim.[143] According to a Stanford scholar, Nature Conservancy is “engaged in the business of creating fake carbon offsets”[144] by protecting forests that do not need protecting.[145] That is, forests that would not have been touched anyway. The controversy led to Nature Conservancy starting an internal review to assess the quality of the millions of dollars of offsets it had sold to such corporate giants.[146]

Admittedly, because developing and monitoring projects is inherently complex, instances of inflated offsets and disagreement over the quality of some offsets are inevitable. However, as we discuss in the following Sections, the way the market is structured gives relevant actors insufficient incentives to minimize offset inflation. The literature on credit-rating agencies has shown that the revenue model adopted by standard setters and VVBs, the issuer-pays model, creates significant problems when either of the following two conditions is met: (i) buyers do not detect and punish inflated certifications, or (ii) certifications also result in regulatory benefits. In the next Sections, we explain the extent to which these two conditions hold true in the VCM. Here, we note that one additional characteristic of the VCM pushes in the direction of inflating offsets, namely the fee structure we have described in Section III.B.2: by correlating fees to the credits certified, standard setters have a self-evident incentive to inflate credits, which exacerbates the concerns about the issuer-pays model.

A. The Issuer-Pays Model

In financial regulation, the issuer-pays model refers to a situation in which a gatekeeper lending its reputation to issuers of listed securities or debt instruments receives its principal source of revenues from the issuers themselves.[147] In its essence, this model also characterizes the two main relationships in the VCM: the one between the project developer and the standard setter and the one between the project developer and the VVB. In the former relationship, the project developer, whose project needs to be evaluated, pays the standard setter, whose fee depends on the number of carbon offsets certified.[148] In the latter relationship, the VVB, which needs to evaluate the validity of the project, is also paid by the project developer.

In principle, the issuer-pays model need not result in offset inflation. True, all three parties involved in these relationships can potentially benefit from offset inflation. The project developer benefits because the higher the number of certified carbon offsets, the more carbon credits can be exchanged and sold on the market. The standard setter benefits because more certified offsets generate higher revenues.[149] Last, as the VVBs are hired and paid by the developers, they have incentives to be lax in their assessments in order to please their clients, knowing that by doing so they might have a better chance of being asked to validate another project in the future.[150]

Yet, if the buyers could assess perfectly well when offsets are inflated and had incentives to punish those who certify inflated offsets, then the issuer-pays model would raise no concern.[151] Assume a credit buyer has to choose between two offset projects and can tell without a shadow of a doubt that one corresponds to a real reduction in emissions while the other does not. It would be safe to say that the buyer would prefer the former and would no longer even consider the services of the standard setter and the VVB that certified and validated the latter offset as reliable. In turn, this would mitigate market players’ incentives to inflate offsets, as they would lose revenues and harm their reputations by doing so.[152] However, as we explain in the next Sections, this reputational constraint is unlikely to operate optimally in the VCM.

B. If Buyers Fail to Detect and Punish Inflated Certifications

Credence goods are services or products that consumers typically lack the expertise to evaluate the quality of even after they have been used.[153] A classic example of credence goods are medical diagnoses and treatment plans.[154] Because of the complexity of medical conditions and treatments, it is often impossible for a patient to assess the quality of the medical advice received, even after observing the health outcome.

Carbon offsets can also be considered credence goods, as determining their quality involves an extremely complex process that final consumers cannot second-guess even after the purchase.[155] For this reason, individuals are unable to punish standard setters that inflate offsets or VVBs that are too lax in their assessment. If individuals cannot detect and punish inflated offsets, reputational sanctions associated with selling them low-quality offsets are unlikely to constrain the behavior of standard setters and VVBs.[156] But why would individuals and corporations purchase offsets when they cannot assess their quality?

One plausible answer is that some buyers might simply take certifications at face value. Focusing on the market for ratings, Bolton, Freixas, and Shapiro show that when a sufficiently large fraction of investors is trusting (i.e., takes ratings at face value), rating agencies can increase their profits by inflating their ratings.[157] This condition is likely to hold for individuals in the market for offsets. On the one hand, as noted above, individuals cannot assess the quality of offsets.[158] On the other hand, a significant fraction of buyers might be driven by selfish reasons and thus overlook the possibility that offsets are inflated.

Economics literature has long established that people tend to donate even when their donation has no real impact. This is because donating generates a so-called “warm glow.”[159] In an interesting experiment, Crumpler and Grossman provide participants with an endowment and then let them decide which portion of the endowment they intend to donate to a charity.[160] However, they also explain that the amount the charity will receive is fixed, regardless of how much the participant decides to donate. In fact, for each dollar the participant donates, the same amount is deducted from the sum donated by the experimenter. Under these conditions, somebody who is donating only for altruistic reasons (i.e., to benefit the charitable cause) would have no incentive to donate. Crumpler and Grossman find that under these conditions, most people still donate to the charity, evidently for the “warm glow” they derive from donating.[161] As empirical evidence shows that pro-environmental behavior also triggers a warm glow,[162] a similar dynamic is likely to unfold for offsets. Thus, people might be willing to purchase carbon offsets regardless of their quality just to feel a warm glow.

Individuals are not the only buyers of offsets. In fact, demand for VCM offsets is currently driven by corporations.[163] But there are several reasons to believe that corporations will neither act as the informed marginal consumers that may make information asymmetries less troublesome in consumer markets[164] nor impose reputational sanctions preventing developers, standard setters, and VVBs from profiting from the inflation of offsets. First, many large buyers prefer to buy offsets via bilateral deals with project developers,[165] which means that they have access to a different set of projects than individuals. For instance, as we have seen in Section III.B.1, Shell launched a partnership to develop offsets that it will purchase directly from the developer. For this reason, even assuming that Shell is able and willing to ensure the quality of offsets, it will only do so for the offsets that it will purchase and not for the ones sold to individuals. Second, in the absence of blatant violations, even corporations might have a hard time screening offsets for quality. Validation and monitoring of offsets entail a very complex process for which there is a shortage of skills, as testified by the dramatic bottleneck caused by the lack of qualified VVBs.[166] It appears unreasonable to expect that firms engaged in completely different activities have the in-house skills to assess the quality of offsets.

Most importantly, given that for individuals carbon credits are a credence good,[167] corporations are unlikely to face any reputational sanctions on the product market for purchasing low-quality offsets. Thus, corporations have incentives to purchase cheap and inflated offsets so that they can appear sustainable at a lower cost.

One possible constraint may come from concerned stakeholders, such as investors following environmental, social, and governance (ESG) criteria. Consider the case of asset managers. As previously mentioned, corporations might purchase offsets not only to please final consumers but also to be included in the portfolios of the many asset managers and asset owners who have undertaken efforts to reduce their portfolios’ emission intensity.[168] Asset managers’ incentives may thus, in theory, affect corporate buyers’ behavior. Yet, asset managers themselves have very limited incentives to verify the quality of the offsets purchased by companies in their portfolios. On the one hand, verifying the quality of offsets bought by each and any of their portfolio companies would be extremely expensive and greatly increase their costs. On the other, it is unlikely that their customers could evaluate their screening procedures. Hence, asset managers would derive minimal financial benefits from investing in monitoring offsets.

In summary, reputational sanctions can constrain the behavior of VVBs and standard setters under an issuer-pays model only if the demand side of the market is both able and willing to punish low-quality offsets. As we have discussed, this does not appear to be the case. Therefore, the issuer-pays model is likely to lead to inflated certifications, a conclusion that, incidentally, the extremely low prices found in the VCM appear to confirm.[169] In fact, low prices suggest that the demand side is unable and unwilling to push cheap low-quality offsets off the market or, worse still, that the VCM is prone to adverse selection.

C. If Regulatory Licenses Exist

Section III.C documented instances of regulations that grant standard setters a regulatory license, that is, regulations attaching positive consequences, such as a lower carbon tax burden, to those who purchase certified carbon credits. The negative implications of granting certification-service providers the ability to sell regulatory benefits are well-known and, therefore, granting standard setters the power to issue regulatory licenses might further exacerbate offset inflation.

To understand why, consider the similar case of credit rating agencies.[170] Over the years, regulators have attached more and more regulatory benefits to high credit ratings.[171] For instance, regulators permit lower capital reserves when the assets held have high credit ratings.[172] In turn, this implies that ratings have a value that is at least in part independent of the reputation of the rating agency that issued it, as the very fact of receiving a positive rating brings with it a regulatory benefit. When the regulatory benefits associated with high ratings become significant, rating agencies find it more profitable to sell regulatory benefits by inflating ratings than to diligently process information according to rigorous methodologies to produce a balanced rating.[173] As noted by Professor Frank Partnoy, this problem “can be generalized beyond credit ratings to any area in which the regulator privatizes a rating function by incorporating the ratings of a fixed number of raters into substantive regulation.”[174]

In short, both economic theory and experience suggest that regulatory licenses for standard setters are likely to further displace the weak reputational mechanisms we have highlighted above.[175] Thus, granting standard setters a regulatory license is likely to lower the quality of the offsets certified on the VCM.

V. What Policymakers Should and Should Not Do

Parts II through IV described the functioning and the importance of the VCM as well as the market failures plaguing it. In this Part, we discuss what policymakers should and should not do to ameliorate—or at least not worsen—the functioning of the VCM. Table 2 summarizes our suggestions, while the next two Sections discuss each of the points mentioned in Table 2 in more detail. Finally, we offer an example of policy intervention that builds on these guidelines.

| Table 2: Dos and Don’ts | |

| Dos | Don’ts |

| Increase the transparency of the market | Implement command-and-control regulations |

| Give incentives to agents who possess the relevant information to identify low-quality offsets | Impose ex-post liability |

| Strengthen reputational sanctions for inaccurate certifications | Grant regulatory licenses |

A. Don’ts

We identify three approaches that policymakers should refrain from endorsing: (1) imposing stringent command-and-control regulations, (2) imposing gatekeeper liability, and (3) granting gatekeepers regulatory licenses.

1. Command-and-Control Regulations

Command-and-control regulations comprise a broad range of measures that affect an activity with a view to address the related market failures. As discussed in Section III.C, various Democratic members of Congress have advocated for command-and-control regulations.[176]

However, putting such a recipe into practice is easier said than done. Command-and-control regulations can only be efficient if policymakers have sufficient information on the optimal conduct and can detect and sanction violations by the regulatees.[177] These conditions are not satisfied in the VCM. For a single aspect alone—determining baseline emissions—the Clean Development Mechanism has adopted more than two hundred different methodologies.[178] Thus, setting standards sufficiently comprehensive to ensure that offsets effectively reduce GHG emissions would require an enormous amount of information. Furthermore, projects are carried out in the most disparate parts of the globe; hence, assessing their impact and verifying their performance often requires a deep understanding of local conditions. Not coincidentally, the calls from Democratic policymakers are very vague: they mention the identification of appropriate standards but fail to specify what those standards might be.[179]

There is ample evidence supporting the view that regulated offset markets do not necessarily produce high-quality offsets. For instance, a study carried out by scientists from the University of Berkeley analyzed the offset credits issued by the California Air Resources Board and found that more than four-fifths of them were inflated.[180] More recent research has further corroborated the idea that California’s forest carbon offsets program is systematically over-crediting.[181]

The situation is similar in Australia. Professor Andrew Macintosh, the creator of the Emissions Reduction Fund’s carbon credit scheme, found that 70 to 80 percent of the Australian Carbon Credit Units issued by the Clean Energy Regulator are “devoid of integrity—they do not represent real and additional abatement”[182] and characterized those Units as “a fraud on the environment, a fraud on taxpayers and a fraud on unwitting private buyers.”[183]

Stunning figures have also been reported in two studies focusing on the Clean Development Mechanism. One study finds that for 85 percent of the projects it covered, there is a small probability that emissions reductions are additional and not overestimated, whereas for only 2 percent of the projects, there is a high probability that emissions reductions are additional and not overestimated.[184] The other study observes that at least 52 percent of the analyzed carbon offsets do not meet the additionality requirement.[185] Indeed, compliance markets are considered so unreliable that a Gold Standard spokesperson said that the group would not certify “any offsets from the UN’s [Reducing Emissions from Deforestation and Forest Degradation] forest conservation program, even though it accounts for 80% of global forest-based offsets, because baseline accounting problems are so pervasive.”[186] In other words, the largest regulated market has produced standards that are deemed to be too low by VCM participants.

Given the poor results of regulated markets, it would seem preferable to preserve a space in which private experimentation and market mechanisms can lead to the development of new solutions and new standards.

2. Gatekeeper Liability

Another possible approach could be making standard setters—and eventually VVBs—liable when they certify low-quality offsets. The fundamental premise on which gatekeeper liability is grounded is that gatekeepers are in a position to reduce the risk of misconduct on the part of their clients.[187] When this requirement is met and when the government can accurately identify the optimal level of gatekeeper monitoring as well as observe gatekeepers’ actual level of monitoring, imposing ex-post liability for inaccurate certification can provide gatekeepers with the right incentives.[188] Whether this is actually the case in a given market is an empirical question. For instance, Professor John Coffee argued that defining the standard of care for credit rating agencies would be akin to descending into the Serbonian bog.[189] Given the complexity and the heterogeneity of the problems that arise in developing and monitoring the development process of carbon offsets, defining appropriate standards of care would be orders of magnitude more complex with respect to the VCM than for the credit rating market. And while adopting a strict liability rule would spare courts the need to identify the optimal level of care, it would still leave them wrestling with the no-less-thorny issue of identifying low-quality offsets.

Under these circumstances, courts are likely to set standards that are either too lax or too stringent. Lax standards would fail to induce VVBs and standard setters to adopt an optimal level of monitoring, whereas excessively stringent standards might even lead to the unraveling of the market.

Market unraveling is a serious and concrete threat. On the one hand, given the complexity of verifying and monitoring projects, even well-intentioned VVBs and standard setters can make mistakes relatively frequently. Being forced to pay monetary damages in all these circumstances might force VVBs and standard setters to abandon the market. On the other hand, the low price at which carbon offsets currently trade implies that often the margins for project developers are fairly small.[190] Were VVBs and standard setters to increase their fees substantially to cover the costs of the expected liability, this could drive many project developers out of the market.

Furthermore, given the complexity that characterizes the VCM, it is unlikely that courts would be able to formulate a single and predictable standard. In the presence of uncertainty as to the required behavior, one of two negative consequences could arise. First, where uncertainty as to how to behave is extreme, parties could be expected to limit their investment in compliance and, more specifically, in ensuring that the offsets are of sufficiently high quality.[191] Second, parties may have incentives to invest excessively in precautions,[192] which might stifle innovation and further increase the risk of market unraveling.

Furthermore, to hold the gatekeeper liable, the plaintiff would have to prove that its conduct caused the victim’s loss, and then the court would have to quantify such loss. In this context, for liability to be triggered, either the standard setter or the VVB must have caused a quantifiable harm to the buyers of the offsets. While the specific details would depend on the way a liability regime for standard setters and VVB is implemented, assessing causation and estimating harm would be very complex.

3. Regulatory Licenses

Policymakers around the globe have started incorporating certifications from leading standard setters in their regulations.[193] The rationale is that leading standard setters are the best suited actors to identify high-quality offsets. However, as discussed in Section IV.C, regulatory licenses displace reputational sanctions, which are crucial to ensure that standard setters have incentives to avoid offset inflation. From this perspective, the granting of a key regulatory license to standard setters within the CORSIA scheme and the carbon tax mechanism of South Africa and Colombia was a step in the wrong direction. Worryingly, other countries seem to be inclined to grant leading standard setters the power to issue regulatory licenses.[194]

B. Dos

Especially with respect to new markets, it is of course easier to identify policy recipes that would not help than those which might bear fruit. With that in mind, we now turn to outline a set of suggestions that, implemented together, could improve the functioning of the VCM.

1. Increase Transparency

When it comes to improving the functioning of the VCM, the key mantra is greater transparency.[195] A promising attempt in this direction comes in the form of the Climate Warehouse of the World Bank, which is a “public metadata layer that uses blockchain technology to facilitate peer-to-peer connections among decentralized registries to link, aggregate, and harmonize underlying data, and enable the transparent accounting of [internationally transferred mitigation outcomes].”[196] In a nutshell, the Climate Warehouse is a meta-registry that uses a uniform format to report information on the VCM projects included in the various privately administered registries.

The Climate Warehouse is built using a blockchain technology which, according to the developers, provides four key advantages: a fully auditable and secure record of transactions (transparency); decentralized governance and peer-to-peer support (accountability); full immutability and traceability (integrity); and inclusiveness, thanks to the fact that the meta-registry is “public, fully open-source, and permissionless.”[197]

While commendable, this initiative will not be sufficient to improve the functioning of the VCM. First, while the kind of information made available is instrumental to avoid double counting and facilitate offsets trading, it indicates nothing about the quality of the offsets themselves. Second, a system that gives information relevant to quality assessments would not of itself achieve much unless the market failures described in Part IV were addressed. Even with enhanced disclosure, standard setters and project developers would keep profiting more by inflating offsets, and reputational sanctions would still be ineffective so long as carbon offsets buyers are unable (or unwilling) to assess offsets quality. In other words (and assuming, for the sake of argument, that the regulator correctly identifies the information contents that would matter for its intended users), while information would become more accessible, there would be no agents with sufficient incentives to identify and punish gatekeepers certifying low-quality offsets. Consequently, reputational sanctions would remain ineffective.

Increased transparency must thus be coupled with two additional interventions if it is to have a positive impact on the market: first, agents with the relevant knowledge and expertise should be given the incentive to identify low-quality offsets; and second, mechanisms to strengthen reputational sanctions for inaccurate certifications should be in place. These two proposed interventions are discussed in turn.

2. Tweaking Standard Setters’ Incentives

As discussed in Section IV.A, the fundamental problem of the VCM is that there are no market players with sufficient incentives to invest resources in detecting low-quality offsets. One possible solution would be to devise a mechanism to promote private litigation with a view to enhance the effectiveness of reputational sanctions. The basic idea is to give NGOs standing to sue standard setters and VVBs who have posted inaccurate information on the World Bank’s Climate Warehouse and reward them for proving that the information was indeed inaccurate.

Five important questions regarding the mechanics of the dispute resolution system we propose are: (i) How would this reward system work? (ii) Who would provide the monetary rewards for NGOs? (iii) Who would bear the litigation costs? (iv) Who would adjudicate the cases? And (v) what sanctions would standard setters face when it is found that they have inflated offsets? We discuss each question in turn.

First, we suggest implementing a mechanism that provides financial rewards to NGOs that prevail in the litigation, having successfully identified inflated offsets. To do so, the first step would entail creating a fund from which the NGOs would be compensated. We argue that the fund should be financed by governments and/or corporations. Corporations, however, should be under no obligation to contribute. Yet, contributions made by each company should be displayed in the registry. We include in the appendix a simple game showing that, under plausible assumptions, companies would have incentives to contribute voluntarily. Clearly, the system would be perceived as more legitimate by market players if they were to choose to be part of it.

The best way to understand why corporations would have incentives to fund this mechanism is to imagine the different reputational consequences they would face if the offsets they purchased were found to be of low quality. Of course, if a company is caught advertising low-quality offsets, the reputational consequences are likely to be negative and the company would be accused of greenwashing. For instance, if an investigative report by a newspaper discovers that Shell has purchased low-quality offsets, then Shell would be perceived as guilty of greenwashing. On the contrary, if Shell had contributed to the fund, it could easily spin the message. While it would still be true that it bought low-quality offsets, the entity identifying them as such would be given a financial reward to which Shell itself had contributed. In other words, on top of indirectly paying standard setters and VVBs to certify the offsets, Shell would be financing a system in which actors are rewarded for identifying low-quality offsets among the ones it has purchased. It would be difficult to ask more of a corporation, considering that directly investigating the quality of offsets is beyond its core competencies. Thus, contributing to the proposed mechanism would reduce the reputational sanctions that corporations face when purchasing low-quality offsets. While we have argued that these reputational sanctions are unlikely to be of a sufficient magnitude to deter the inflation of offsets, they are likely to be larger than the relatively small sums companies should donate to make the proposed system work.[198]

At the end of each year, the NGOs that have successfully identified inflated offsets would split the fund, with each NGO receiving a fraction of the fund that is proportional to the inflated offset it identified. For instance, assume that the fund is $100 million. Assume also that two NGOs have identified inflated offsets, one for thirty tons of CO2 and the other for twenty tons of CO2. Then, the first NGO would receive 60 percent of the fund ($60 million) and the second would receive 40 percent ($40 million). This litigation mechanism would then give hard monetary incentives to NGOs and other actors to detect low-quality offsets.

Second, we suggest that the allocation of litigation costs should depend on the outcome of the procedure. If the claimant (i.e., the NGO) wins, the defendant refunds litigation expenses. If the claimant loses, then the fund covers those expenses, unless the adjudicators consider the case brought by the NGO to be frivolous. In that case, litigation expenses would have to be covered by the NGO. To further minimize the risk of frivolous litigation, policymakers could impose a limit on the number of times an NGO can have its litigation costs covered by the fund before having to pay its own litigation expenses.

Third, we suggest that the selection of the adjudicators should mirror arbitration. That is, each party selects one arbitrator, while the third arbitrator is jointly appointed by the parties.[199] If the parties cannot reach an agreement, the third arbitrator would be appointed by the World Bank, as already happens at the International Centre for Settlement of Investment Disputes.[200] A key advantage of this appointment procedure is that it strengthens parties’ support for the entire process.[201]

Last, we argue that even when it is established that standard setters have certified inflated ratings, there should be no monetary sanction. In fact, as discussed in Section V.A.2, discriminating between high-quality and low-quality offsets is a highly complex task, and there would thus be a high number of false positives and false negatives. That situation, combined with monetary sanctions, would likely push standard setters and VVBs out of the market.

This mechanism, while helpful, would be insufficient. As it ultimately relies on reputational sanctions for the VCM players, what must additionally be ensured is that the information about litigation outcomes reaches offset buyers and the public more generally.

3. Strengthening Reputational Sanctions for Inaccurate Certifications

Transparency and litigation could improve the functioning of the VCM only if reputational sanctions were attached to undesirable behavior. For that to be the case, information must be presented in a way that makes it easy for offset buyers—and for their investors and customers assigning a value to those buyers’ net emissions—to identify low-quality offsets. However, these actors have limited incentives to invest resources for the purpose of deciphering the complex information pertaining to offset projects. Thus, we suggest that the outcome of the litigation should be summarized in a way that people can easily process and understand.

In particular, we suggest that red flags should appear in an aggregation platform, such as the Climate Warehouse, next to projects that have undergone the litigation process and for which it has been shown that the number of certified offsets was inflated. Projects that did not result in any real avoidance or removal of GHGs should appear with five red flags. This would be the case for a project that protects a forest that has never been in danger. For projects that only avoided or removed up to 20 percent of the emissions claimed, the Climate Warehouse should display four red flags, and so on.

The aggregating platform could then include a ranking with the performance of the various standard setters indicating how many red flags they received and how many offsets they certified.[202]

There are multiple reasons to believe that this mechanism would be effective in conveying relevant information to offset buyers. First, summarizing information using a coarse visual scale has been proven to influence behaviors. For instance, Morningstar displays one to five globes next to the name of asset managers, depending on their ESG scores. Evidence shows that investors have responded to this way of conveying information.[203] Second, other evidence suggests that using color codes is a very effective way of conveying information.[204] Visually highlighting negative performance in red would likely thus nudge buyers into processing the relevant information and making comparisons among offset projects and market players.

Moreover, as the market grows, so does the interest in carbon offsets. This is clearly testified by the growth in the number of Google searches for “carbon offset” (see Figure 4).[205]

Figure 4: Google searches for “carbon offsets” in the United States between February 2013 and November 2023

Furthermore, the VCM has also garnered attention from news sources that frequently report on carbon offsets and scandals associated with them.[206] However, despite the increasing attention, gathering information on problems in the VCM is a daunting task, given the lack of transparency. Once the system we propose is in place and litigation outcomes become available, news sources would be able to identify problematic projects and compare the average performance among standard setters. For instance, a very quick search would immediately reveal which receives more red flags between Verra and Gold Standard. In turn, this would greatly increase news sources’ ability to report interesting information on the VCM.

4. Advantages of Our Suggested Approach

We have already discussed how our set of suggestions incentivizes agents possessing the relevant information to identify low-quality offsets while at the same time strengthening reputational sanctions for inaccurate certifications. But there would be further advantages from implementing our suggestions.

To begin with, we noted that the VCM is not only the creation of private actors but also self-regulated. Our suggestions are consistent with this key feature of the VCM, as the sanctions would be issued following private litigation and adjudicated by actors appointed by private parties. Parties’ ability to select their own arbitrators is one of the main reasons why private parties rely on arbitration to adjudicate their disputes.[207] This is because having a say in who decides the case is “reassuring, and strengthens [the] support for the entire process.”[208] Thus, in a market that has been created by private parties for private parties, it seems only natural that private parties would decide who adjudicates the emerging disputes.